Know about the different types of ITR forms

Every taxpayer must submit an income tax return to the income tax department. The process of filing is critical and needs to be done on time.

ITR filing is quite simple, because it provides all information about the income earned by each person. The slab rates for collecting taxes are determined based on the information collected.

Taxpayers generally fall into different categories when it comes to filing the ITR. How to file the right ITR and what’s the different types of forms available is what we are about to see in this article.

What are ITR forms?

Not that everyone earns the same and pays the same amount of tax. There are different levels and categories for ITR filing among tax payers. There are several types of ITR forms offered by the Income Tax Department to distinguish between them.

The purpose of submitting an ITR is to provide details related to income, expenses and other information that are relevant to every tax payer. Based on the information collected, the right percentage of tax will be calculated.

We are now trying to determine in which category each taxpayer fits, so that the right ITR form can be submitted to the IRS.

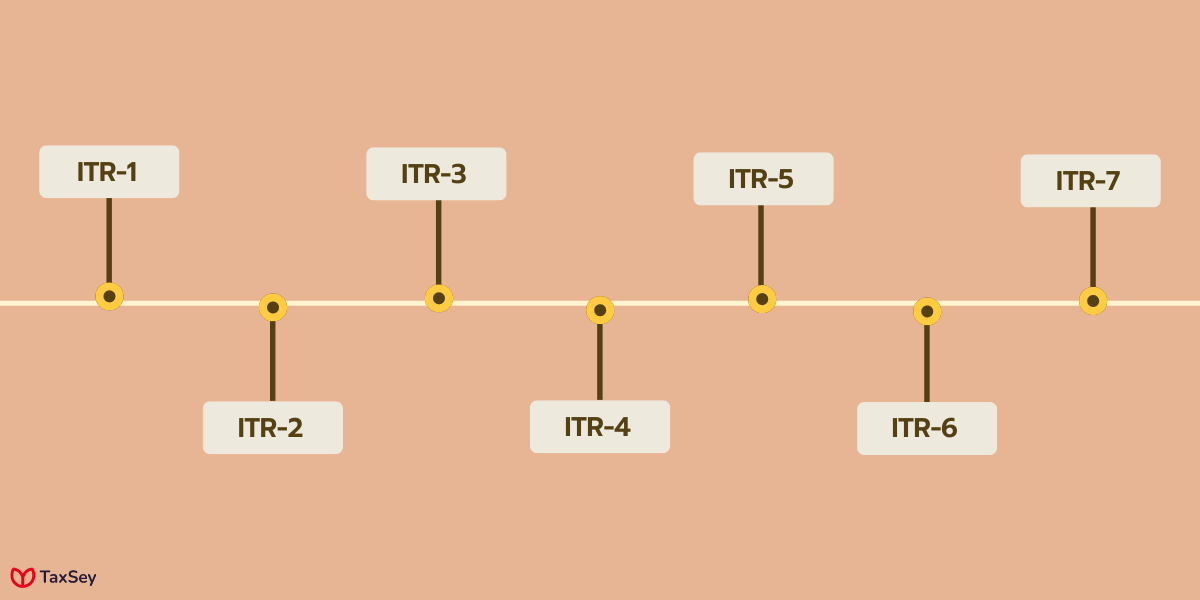

Types of ITR forms:

ITR forms are categorized into seven types. This differentiation is based on the factors such as,

-

If the taxpayers are individuals, or they own a company

-

Source of income

-

Amount of income earned.

Information collected through ITR forms includes the income earned by the taxpayer, expenses and purchases made, investments and tax paid in one financial year.

Choosing between the various types of ITR forms is based on who is applicable and not for filing the form. Filing the wrong form could lead to problems and confusions in the income tax department.

1. ITR-1

ITR-1 is also referred to as SAHAJ. This form can be filled by individuals whose, total income doesn’t exceed Rs. 50 lakh.

Sources of income includes,

- Salary earned by the person

- One house property

- Family pension income

- Agricultural income

- Other sources like, savings from interests.

Individuals who can file ITR-1

- The earned income should be sources mentioned above.

- Agricultural income should not exceed Rs. 5000.

- Other sources should not contain, income from lottery, race horses, and income under section 115BBDA and section 115E.

- Property income should not contain any losses from previous financial year.

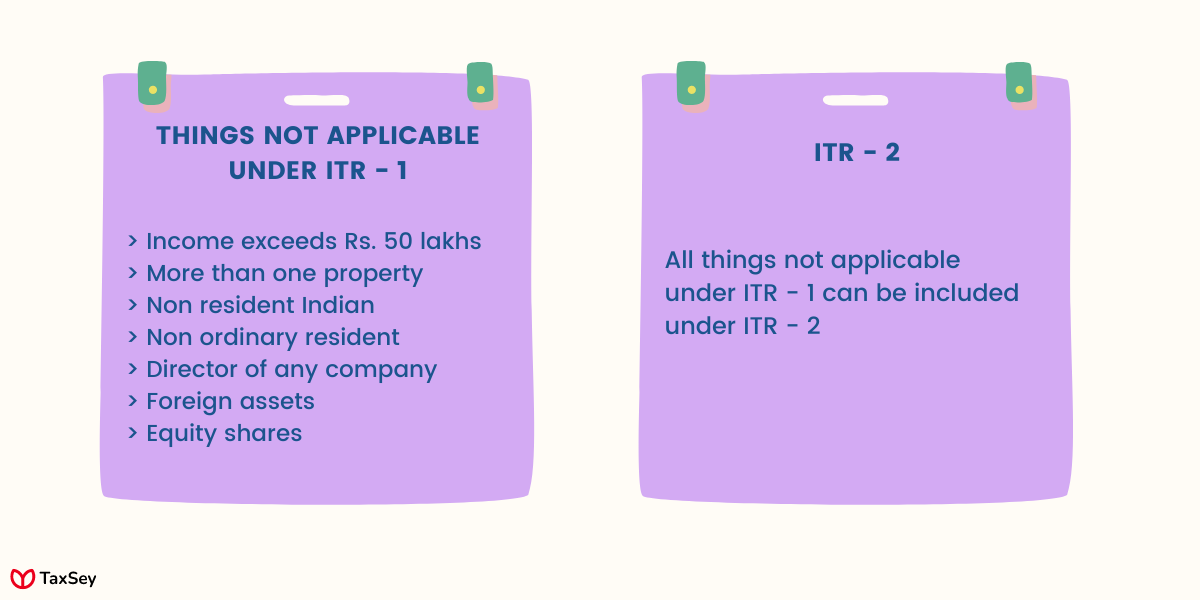

Individuals who can’t file ITR-1

- Individuals with business.

- Total income from all sources should not exceed Rs. 50 lakh.

- Individual should not own property more than one house.

- Not ordinary resident and Non resident Indian.

- Individual shouldn’t be director or any other position of a company.

- Capital gain incomes.

- Individual with property assets or any signing authority outside India.

- Individuals with other equity shares in previous FY.

2. ITR-2

Individuals who fall under the non-applicability category of ITR-1 can file ITR-2 form. But still business or other profession are neglected. Sources of income is same as ITR-1.

Individuals who can file ITR-2

- Total income earned can exceed Rs. 50 lakh.

- Individuals can earn from more than one property.

- Lottery and race horse management is also included.

- Income from foreign assets and property are included.

- Individuals can be director of any company.

- Non resident Indian or Non ordinary resident.

- Agricultural income more than Rs. 5000.

- Other equity shares in the form of investments are also included in ITR-2.

Individuals who can’t file ITR-2

- Tax payers with business or other profession.

- Individuals being partners of any other firm.

3. ITR-3

An individual or a person from HUF with a business or profession are eligible to file ITR-3.

Individuals who can file ITR-3

- Individual who owns a business.

- Individual who is a director of a company.

- Taxpayers can have additional equity shares and investments.

- NRI or NOR

- Partnership in other companies is applicable.

- Foreign assets and income.

- Income can exceed Rs. 50 lakh.

Individuals who can’t file ITR-3

- Large companies and firms.

- People who run trusts.

- Co-operative societies.

- Limited Liability Partnership is not allowed.

- Artificial Judicial person

4. ITR-4

This form is also referred to as SUGAM. This form is applicable to all firms, businesses and HUF’s (except LLP). Individuals who can file ITR-4

- Partnership other than LLP’s.

- Presumptive income under Section 44AD, Section 44ADE, Section 44ADA.

- Total income should not exceed Rs. 50 lakh but turnover can exceed Rs. 2 crore.

- One house property income.

- Income from lottery or races is not eligible.

Individuals who can’t pay ITR-4

- If the individual maintains record apart from presumptive income scheme.

- Agricultural income more than Rs. 5000.

- Individual with additional equity shares.

- Forward or brought forward loss under income from house property.

- Income from lottery, gambling, race horses, etc.

- Director of a company.

- Capital income gains.

- Foreign assets or signing authority outside India, while being a resident of India.

5. ITR-5

This form is applicable to a list of bodies such as,

- BOI - Body of Individuals

- LLP - Limited Liability Partnership

- AJP - Artificial Judicial Person

- AOP - Association of persons.

Individuals who can file ITR-5

- People with investments or partnership

- Trusts and investment funds.

- Insolvent estate - when the deceased person debts are more than the assets owned.

- Local authority and co-operative society.

Individuals who can’t file ITR-5

- Individual tax payers.

- Hindu Undivided Families

- Companies.

6. ITR-6

This form is applicable form companies and firms that do not fall under Section 11 or Income tax act.

Individuals who can file ITR-6:

- Companies not gaining income under Section 11.

- Section 11: Income earned from charity or religious purposes.

Individuals who can’t file ITR-6

- Companies that are eligible for ITR-7

7. ITR-7

Individuals who claim exemptions from various section like are eligible to file ITR-7.

Individuals who can file ITR-7

- Section 139(4A) - Income earned from property that is used as charitable or for religious purposes.

- Section 139(4B) - This is concerned with income earned through political parties.

- Section 139(4C) - Educational or medical institutions, Research association, hospitals, news agency, Institutions under section 10 should file ITR-7.

Individuals who can’t pay ITR-7

Any firm or individual who are not part of the above mentioned sections are not allowed to file ITR-7.

How to file ITR?

The Income tax department of India has offered two ways of filing ITR. It can be done through the e-filing website, or through external java/excel utility.

e-filing website:

- Enter into the website www.incometaxindiaefiling.gov.in.

- Login to your account using your PAN number and password.

- From the menu bar choose the “e-file” option.

- Choose the appropriate assessment year and ITR form.

- Select the filing type as “Original/revised return” and submission mode as “Prepare and submit online”

- Choose a verification option.

- After entering all the required data, check the details by clicking on “Preview and Submit”.

- Click on “Submit” to complete the process.

Utility and Online mode:

- Go to the official website www.incometaxindiaefiling.gov.in.

- Click on “Downloads” from the menu bar.

- Select the appropriate assessment year, and download the given zip folder with various ITR forms.

- The file will contain details that has to be filled.

- Fill the details and save it in the form of XML.

- Now again go to the website and login with your credentials.

- Choose the e-file menu and select assessment year and ITR form.

- Select “Submission mode” and upload the saved XML file.

- Now click on “Verify” and “Submit” to file the ITR.

Conclusion:

ITR forms are extremely important to keep a track on the income earned by every individual and to fix slab rates accordingly. Selecting the right form is also crucial as it might lead to unwanted confusions later. Generally the department levies a penalty ranging from Rs. 1000 to Rs. 10000 for not filing ITR on the mentioned dates. Therefore it is always advisable to follow the dates and file accordingly.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption.