Steps to file income tax return online

With software and technology advancing everywhere, filing your taxes is now easier than ever. Government of India has made things easier with e-filing facilities, which gets done online in a few seconds.

Income Tax: a short note

Every working employee pays a certain amount to the government in the form of tax. It can be through the purchases made, or the services that are being provided to every individual.

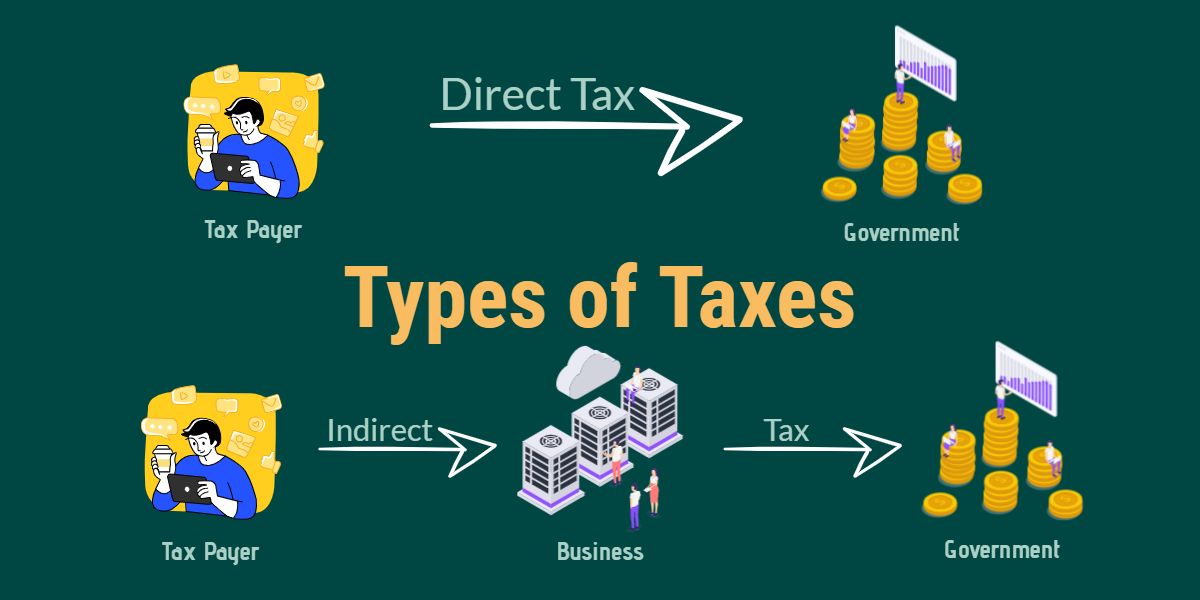

On the basis of how taxes are collected, we can divide them into two categories,

- Direct tax: a non-transferable tax, that is paid directly to the government.

- Indirect tax: this is a transferable tax, where the tax is paid to business or organizations, which is then transferred to the government.

Income tax falls under direct tax, because it is paid directly to the central government without the intervention of other governmental bodies or organizations.

Every employee earns a fixed amount every year, which is known as income. Based on how much an individual earns, the government levies tax on the income that is generated. This tax is called income tax.

Income tax is not mandatory for every citizen in the country; there are certain criteria that define who is a taxpayer. Income taxes are the government's main source of revenue, and the slab rates differ based on how much each person earns.

Forms Applicable For Income Tax:

Each employee of the Income Tax Department of India has to fill out various categories and fields of information. The details are collected using forms, which are of different types.

1. Form 12BB:

Used in places where an employee collected tax details from his employer. In order to record details related to taxes paid and salaries earned, employees submit this form to their higher officials.

2. Form 16:

This is also similar to form 12BB, but this is submitted annually to the employee. Benefits such as tax deductions and tax refunds are sought.

3. Form 16A:

Form 16A is filed to obtain a Tax Deducted at Source (TDS) certificate. This is issued on a quarterly basis, containing information related to various sources of income of the taxpayer.

4. Form 67:

This is used to claim Foreign Tax Credit in India, which basically contains information related to income generated by a taxpayer in foreign countries. By using this, the taxpayer can deduce the taxable amount.

5. Form 26AS:

The Form 26AS is also known as the Annual Information Statement. This form is intended to gather information on tax collected and deducted, advance tax, pending tax, and self assessment to tax paid by individual taxpayers.

6. Form 10E:

This is filed directly to the income tax department of India. The form contains details of arrears pending and received by the taxpayer. Based on the information, the tax amount to be paid every year is adjusted.

What Is Income Tax Return?

Each taxpayer has to file an income tax return (ITR) every year to keep track of the amount of taxes they pay and the amount of income they earn.

Information related to the income earned, tax paid, and expenses incurred that year are collected using a form. Using these information the tax liability is calculated and if the amount paid is more than that, the excess amount is returned as ITR.

The next question is how is ITR filing done?

The Income Tax Department of India has an e-portal that lets individuals file ITR online easily.

Steps To e-File ITR:

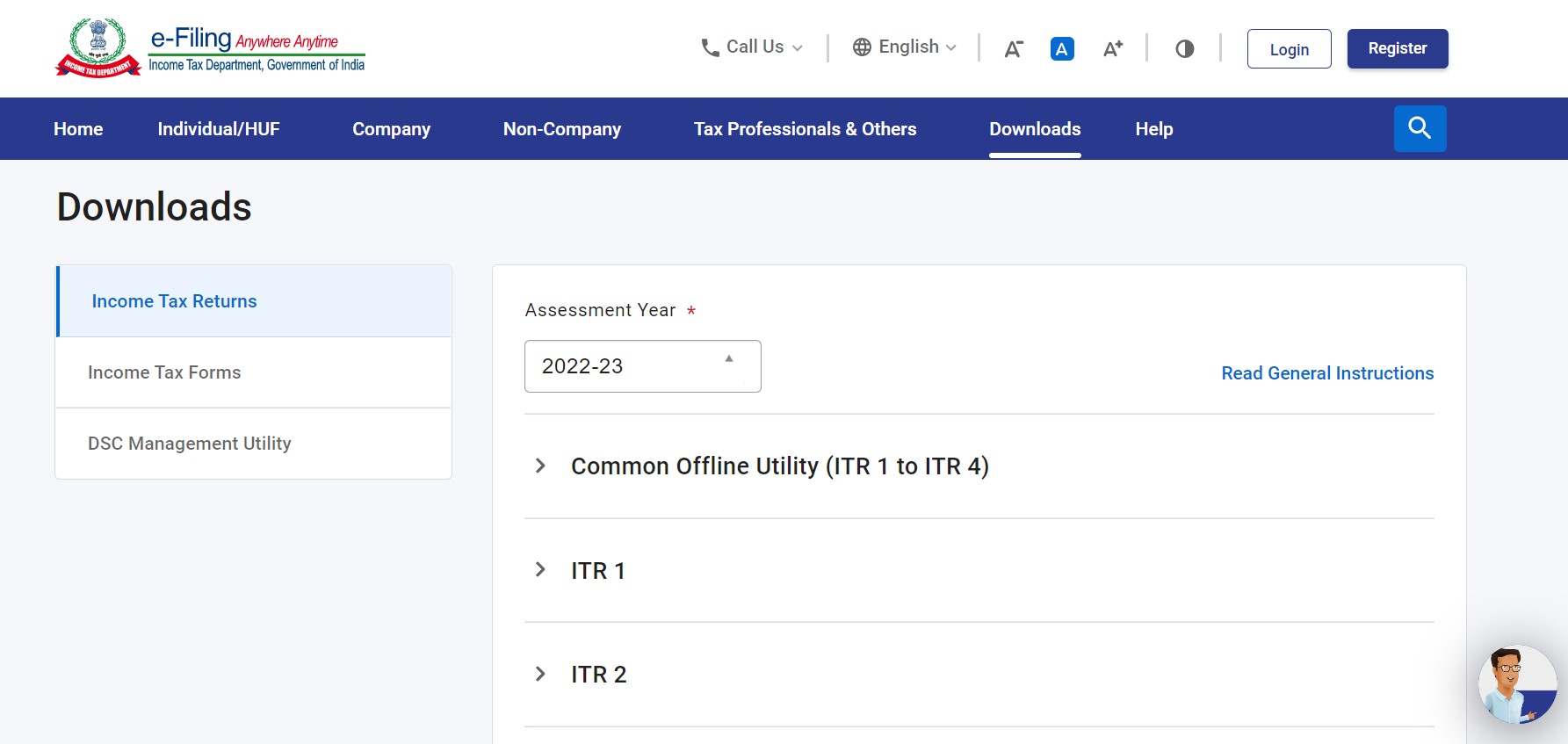

Step 1: Calculate income and choose the right ITR utility

Not all employees are eligible for tax payments. For every employee the percentage of tax to be paid and category they fall in differs significantly.

So the first step before filing ITR is to determine the income and choose the right form that is applicable. Every citizen will fall under ITR1, ITR 2, ITR 3 and ITR 4 divisions, based on their income.

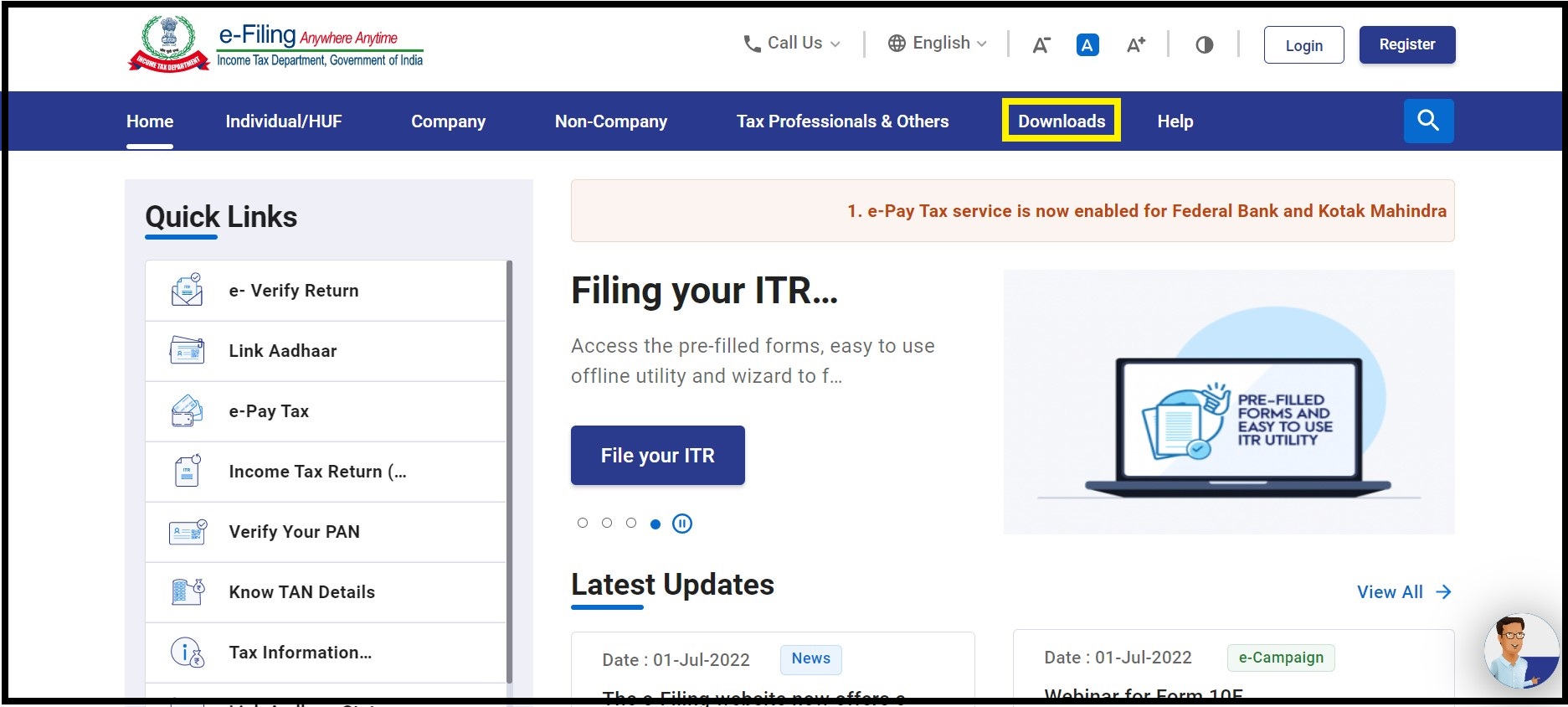

Step 2: Visit the Income tax department website

To start e-filing visit the website https://www.incometax.gov.in/iec/foportal

From the tool bar click on download to get the utility software. Choose the details and select the required form. The utility software will be downloaded in the form of a zip file.

Step 3: Fill in the details and validate

Now fill the mandatory fields and required details asked in the ITR form. After filling the details, validate to make sure that all the fields have been filled with the required information.

Step 4: Convert to XML format

The next step is to generate the form and convert it to XML file format. Save this converted file.

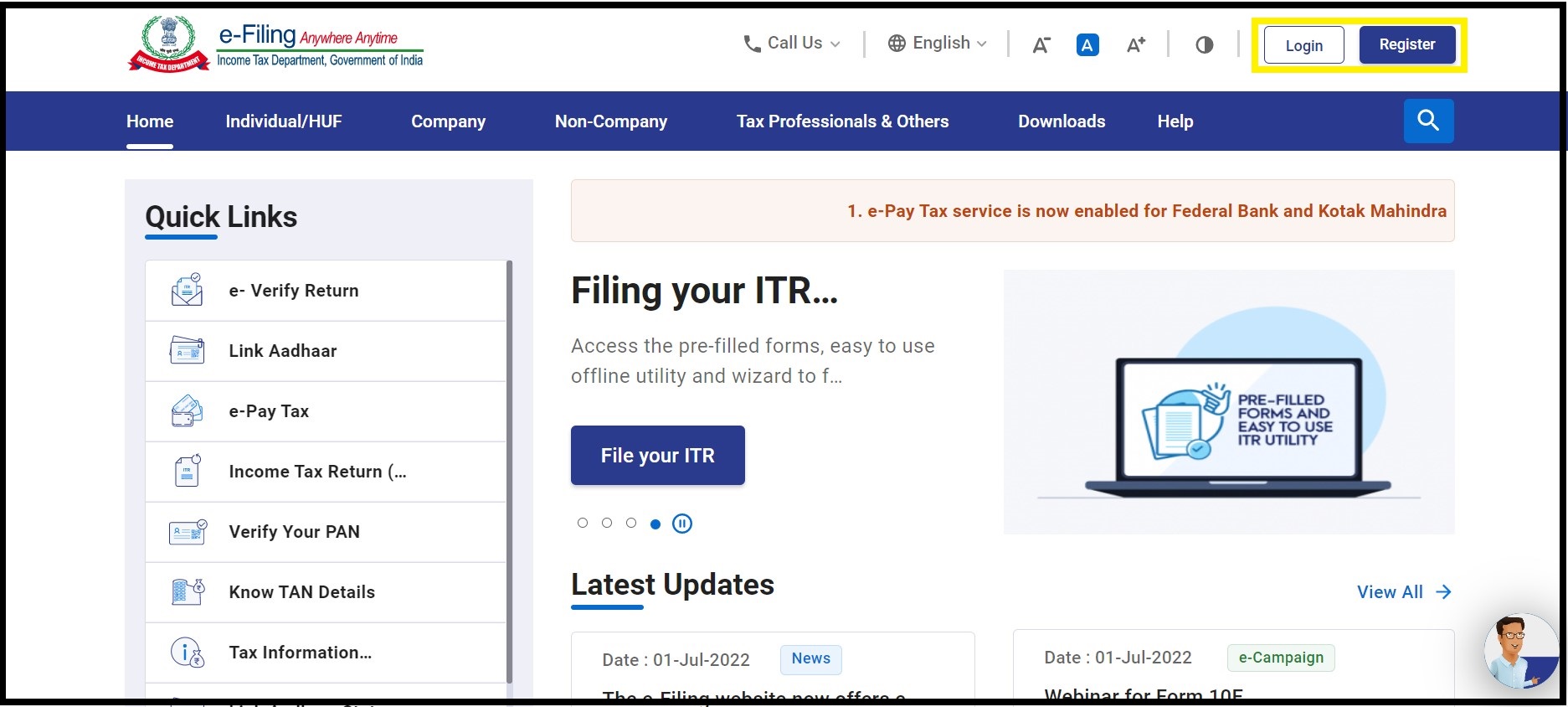

Step 5: Login to e-file portal

Now go back to the e-filing portal and ‘login’ using your credentials. After logging in, click on the ‘e-file’ option from the mail tool bar. Under the e-file option there will be various options, from that choose ‘Income tax return’.

Step 6: Fill in the details.

Under Income tax return page, fill in the required details like

- Pan Number

- Assessment Number

- ITR form number

- Submission mode

Click the continue button below when you are finished filling it out.

Step 7: Attach the XML file

Now attach the generated XML file and move to the verification process.

Step 8: Verification

Now verify the credentials using OTP (One Time Password) or through EVC (Electronic Verification Code) The details to be verified are,

- Aadhaar number

- Bank account

A verification code will be sent to the mobile number registered with UIDAI.

Step 9: Submit the form Once you have provided all the details submit the ITR form. It will take time to verify the submitted details, and you can check the status through the e-verify return feature.

Conclusion:

The purpose of e-filing Income tax return is to get the benefits of refundable tax amount and reducing the total amount of tax to be paid every year. From the overall income, a certain amount of amount is always reduced for every tax payer.

To get this benefit it is mandatory for every tax payer to submit the ITR form. Now that the process has become online, it is far more easier to e-file and record the details that is asked by the Income tax department.

Frequently Asked Questions

An Income tax return (ITR) is a form used to file information about your income and tax to the Income Tax Department. The tax liability of a taxpayer is calculated based on his or her income. In case the return shows that excess tax has been paid during a year, then the individual will be eligible to receive a income tax refund from the Income Tax Department.