GST Council: Everything you need to know

We have been talking a lot about GST in the recent years. In many ways, its implementation resulted in reformations in taxing procedures.

This taxation system has been implemented by the government, but its proper functioning is being overseen by a few members known as the GST council. There could be a lot of questions related to this council and its functioning. Let's take a look at every aspect through this article.

1. Creation Of GST

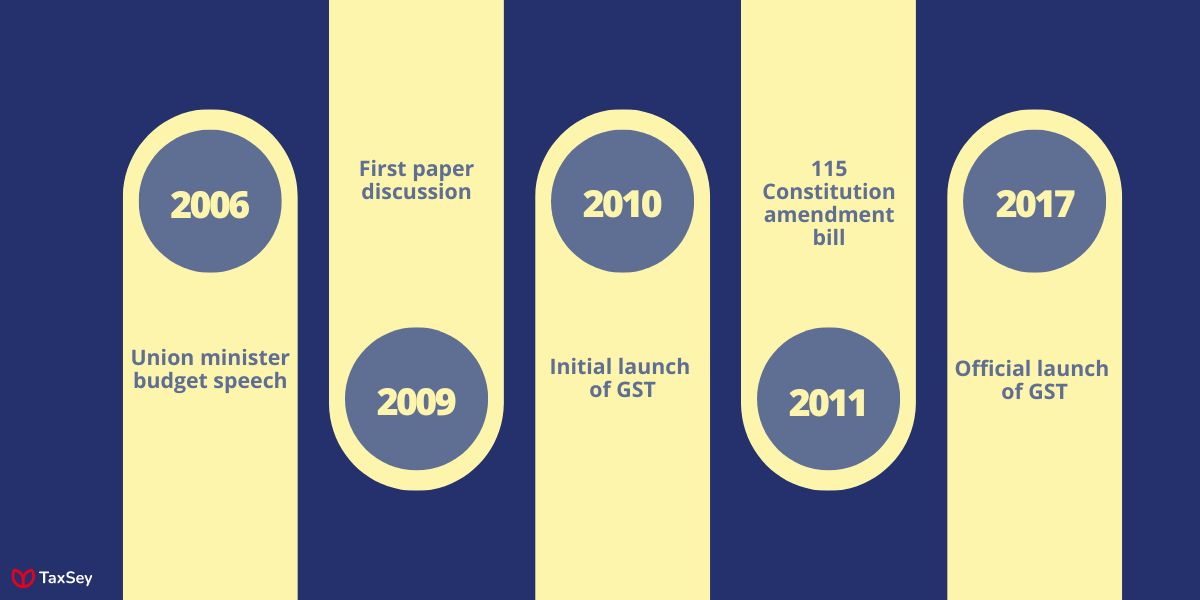

The implementation of GST was not an overnight idea. The idea to form GST was initiated back in 2006 by the then Union Finance Minister.

An Empowerment Committee of State Finance Ministers in consultation with the Central Government released a First Discussion Paper on GST in 2009. It was said that GST will be introduced on 1st April 2017.

However it didn’t happen and then the 115th Constitution Amendment Bill was introduced in 2011 to bring GST. After various discussions and agreements, GST came into effect on 1st July 2017.

2. What is GST council?

Now that GST is all set up across the country, it is not that the government has to take care of all its functions. GST council is a governing body that was established to oversee GST.

GST is the taxation method that combines and constitutes a single tax across all states and union territories. The role of GST council is to regulate and monitor the smooth process of tax collection.

The prime goal behind introducing this council is to ensure that all activities and filing under GST is done properly by all taxpayers. Not just that, GST council also has other authorizations which is explained later.

3. Formation of GST Council

The idea of introducing this council was made before the implementation of GST. Article 279A explains and regulates the formation of the council.

The council is formed and established by the President of India which will act as a constitutional body. This body is the connect between all states and union territories to monitor GST effectively.

The formation of Article 279A was initiated on 10th September 2016 and was immediately enforced on 12th September 2016. It was when a Union Cabinet meeting was held to successfully establish a GST council for the nation.

4. Members of GST council

There is a proper setup for considering members for the GST council. Since some crucial decisions are made by this council, the members play an important role.

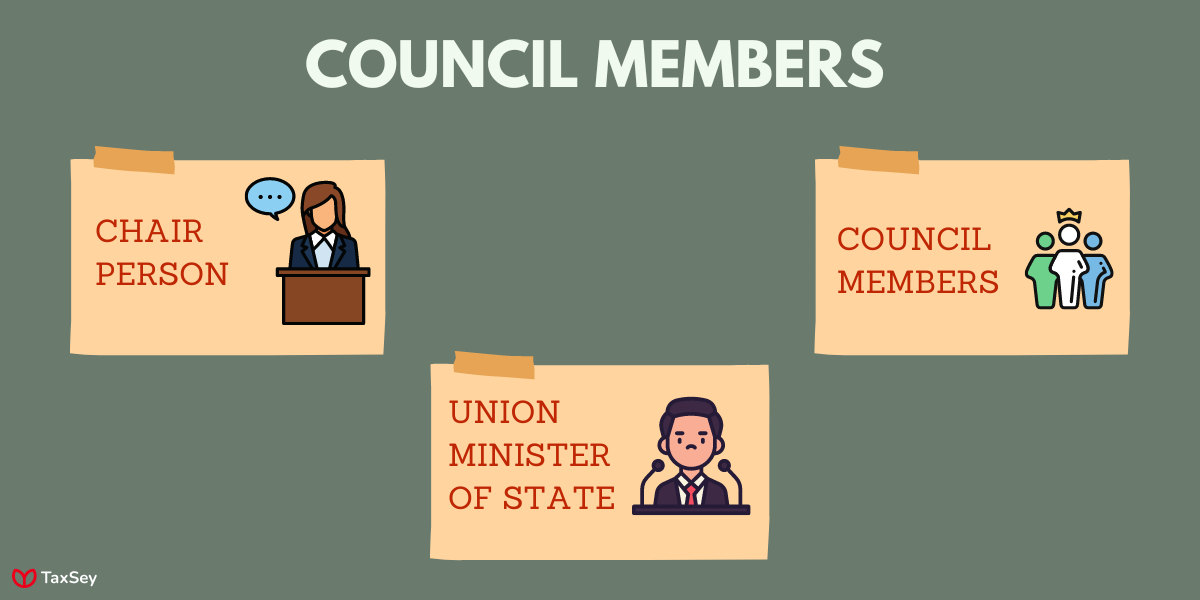

The members of GST council consists of,

- Chairperson: It is the Union Finance Minister of the Government of India.

- Union Minister of State: Whom is in charge of revenue and finance.

- There would also be other members would be the finance ministers or other ministers appointed from every state by the State Government.

The current council members are Smt. Nirmala Sitharaman as the Chairperson and Shri Pankaj Chaudhary as the Union Minister of State. Other members are appointed by the state government who are the finance ministers, deputy chief minister or any other ministers of the state.

So the total council consists of 33 members, consisting of 2 members from the central government. From the remaining 31 members, 28 members are state representatives and 3 members are Union territory representatives.

Why was this council set up?

The main agenda behind setting up this council is to make necessary decisions related to the functioning of GST. It is not that the government has to take care of everything, and that is why the GST council was introduced.

Any changes or recommendations made in the GST law, are verified, regulated and implemented by this council of members. At the same time, the council also ensures that taxes are collected correctly.

Furthermore, it is this council that determines the slab rates and percentage values for goods and services across the nation. So any recommendations from the state have to be presented before the council for implementation.

5. Duties of GST council

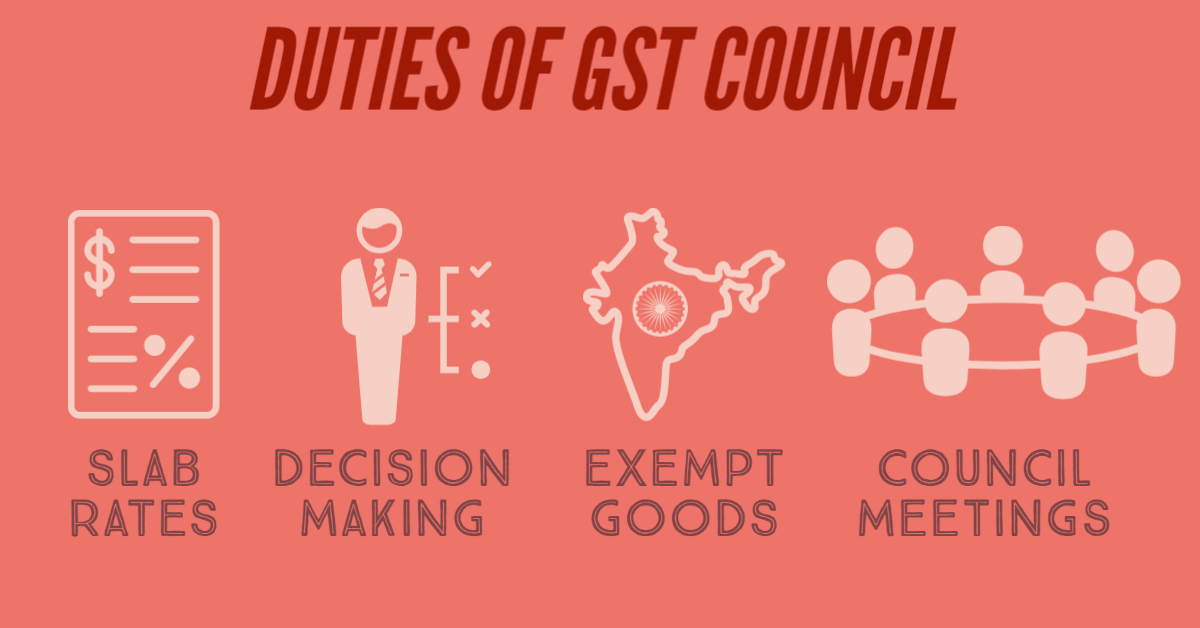

By now, it is evident how important the council is as far as GST decisions are concerned. But still, the council has certain duties to perform.

- It is the council that determineshe percentage of tax that has to be levied.

- It is also responsible for setting up the sub-charges that would be applicable.

- The council has control over choosing the goods and services that would come under exempt category.

- Implementation of GST slab rates for various sectors.

- Determines the threshold limit of GST payment.

- Makes decisions related to the special recommendation for GST exempt.

- Determines the special rates for hilly regions and north-eastern states of India.

- Regulates the GST law.

- Conducts meetings to make decisions at the right time.

Overall it’s the council that has complete control over the functioning of GST across the country.

6. GST Council meeting

As mentioned previously, it is the duty of the council to conduct meetings to decide on the changes made to GST. These meetings are where important decisions are made.

A number of meetings have been held since the council was established. Following discussion with the members, e-way bills and extensions of deadlines are finalized at council meetings.

Even when the dealers or the state have any suggestion or recommendation with the slab rates, then it should be presented before the council for final decisions.

How decisions are made?

- For the meeting to proceed, 50% of the council members should be present to start the meet.

- In order to make a final decision, thereas to be three-fourths of the majority voting from all the members present for that particular meeting. Absentee ballots do not count.

- The votes are split in such a way that, the central body holds one-third of the vote and the remaining two-third is held by the state members.

- The decision of the council is invalid when,

- When there is a vacancy in the council.

- When there is a defect in the constitution of the council.

- When there is a defect in appointing a council member.

- When there is procedural non-compliance.

Conclusion:

The reason why GST was implemented was to bring One Nation One Tax system. In the old tax system there were many disadvantages and problems, which caused confusion in taxing procedures.

Regardless of whether new approaches are implemented, there must be a governing body to monitor and regulate them. GST council was also enforced for this reason.

This regulating body is the key behind all the functioning and collection of tax from the tax payers. Even the smallest mistake or fraud can be detected by this council, ensuring smooth operations.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption. The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.s