GST: The finance term that you need to know

Payment of taxes is an involuntary action that occurs even when a small purchase is made. The charges that are levied as taxes various on different bases on the varied requirements that we need.

The question of how taxes are collected, under what name and so much more may have been on everyone's mind. So lets get started with some taxing terms and changes that were made across India.

Previous Tax Structure:

The old structure of tax collection used in India consisted of various sub-divisions within the method. Different taxes were collected for every commodity, which lead to various sub-divided taxes.

VAT:

VAT stands for Value Added Tax and falls under indirect taxation, which means it is the tax that is paid to the government for the goods and services. It can be defined as a special tax module that is imposed on all purchases made.

To provide an example, every product or commodity that is for sale has a value of its own. A VAT tax is a tax that is imposed on the value of any particular product, which falls under the good and service category.

Sales Tax:

As the name suggests, this tax is also an indirect tax that is imposed on every sale that is made. Though sales are made at different levels, sales tax is collected only from the end user.

Whenever a retailer sells it to his customer, he collects the tax amount first, and then passes it on to the government.

Service Tax:

Customers or end users are responsible for paying this tax, which is imposed on service providers. To make it more clear, the tax is paid by the service providers, but they recover the amount payable from their customers.

Entertainment And Luxury Tax:

Generally, entertainment taxes are imposed on entertainment sources such as movies, sports, exhibitions, gaming, and much more. In terms of luxury taxation, these are imposed on products that are not easily accessible or that are of high value.

GST: Definition

The revised tax structure falls under GST, which is Goods and Services Tax. All other taxes such as VAT, service tax, sales tax, etc, were replaced with this to bring about changes in the old taxing terms.

GST is a wholesome system of collecting tax from the taxpaying citizens, as opposed to collecting it in various ways and at various points. This system was put in place to resolve the problems of the VAT system.

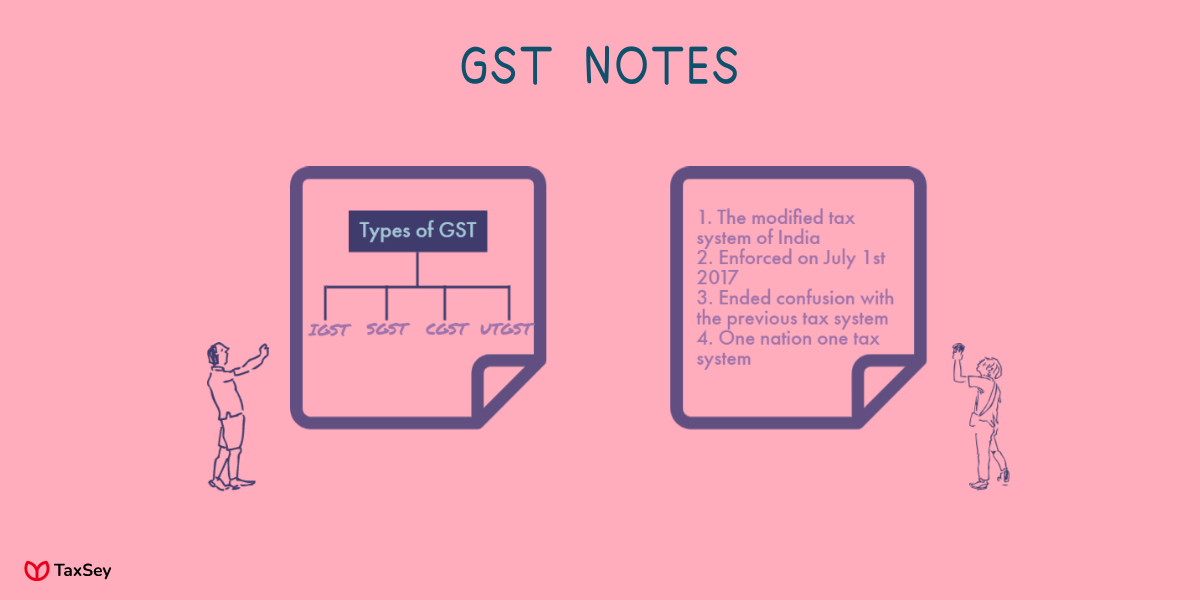

Division Of GST:

The GST has four main branches, to distinguish between the inter-state and intra-state taxing terms in the country,

- IGST - Integrated Goods and Services Tax

- SGST - State Goods and Services Tax

- CGST - Central Goods and Services Tax

- UTGST - Union Territory Goods and Services Tax

1. IGST:

IGST is imposed on imports and exports between two states, i.e., inter-state tax. The tax collecting body is the Central Government, but the collected amount is later distributed among the respective states involved in imports or exports.

In addition to imports and exports, it applies to all services that are provided between two states. As the transactions are interstate, the collected amount is shared among the central and state governing bodies.

2. SGST:

This is an intrastate tax, that is enforced on goods and supplies that take place within the state. The tax is only applicable to purchases, sales, goods and services provided within that particular state.

SGST is not shared with the central body, and so state governments are the sole claimers of the tax amount. The percentage of SGST and CGST is equally divided from the total GST value.

3. CGST:

CGST also falls under intrastate tax terms, but as the name suggests the payable amount is owned by the central government. The transactions and supplies are all carried out in a single state. If so, then it will fall under IGST.

4. UTGST:

This is exactly similar to SGST, but is only applicable for the Union Territories of India. The revenue is collected and used by the Union Territory Government.

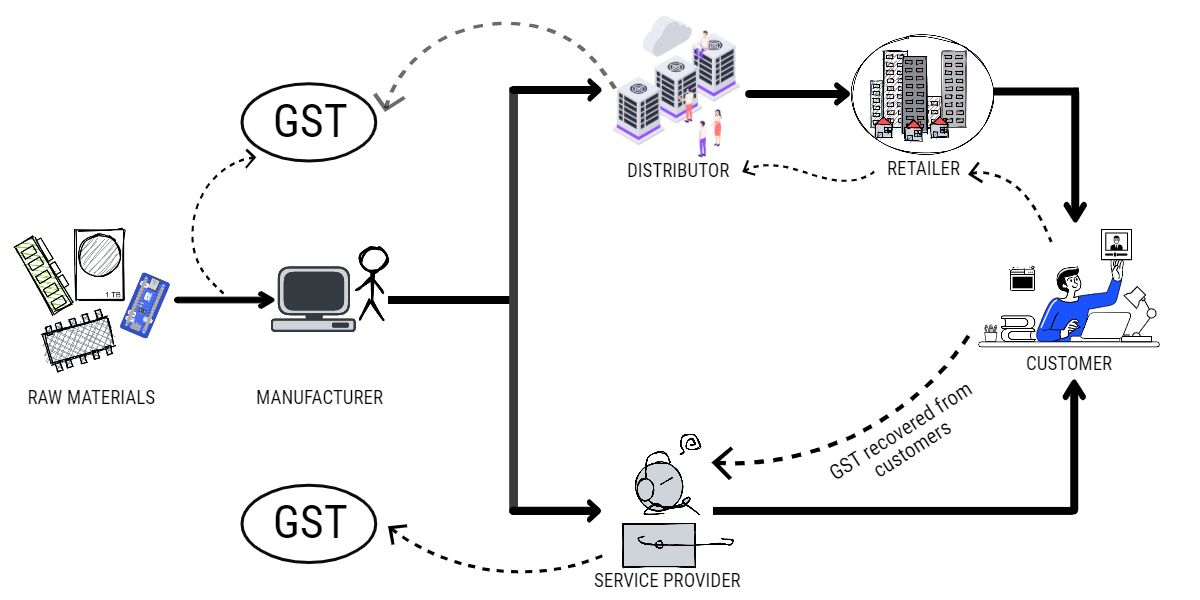

How Is GST Collected?

As mentioned previously, GST is imposed as a single tax across the nation. So this ensures that, with every purchase the customer at that junction needs to pay a particular amount as tax to the central body.

As an example, let's divide laptop sales into four categories.

- Manufacturer

- Distributor/Service provider

- Retailer

- End user

The flow chart of paying GST is as follows,

- To manufacture a computer, the necessary raw materials has to be selected and bought. So the manufacturer at the first place, gets the raw materials and pays GST for the purchase.

- In the next stage, the manufactured computer are sold to the distributors or the service providers. During this purchase, they do pay GST but they can recover it from their customers as well.

- The service providers reaches the customers directly, while the distributors sell the products to the retailers first. At all these steps, the GST that has to be paid can be reduced.

- In the end the customer, needs to pay the designated percentage as GST for the product at the end.

- Similar to VAT, GST is also the tax that is levied for the value and services of the product. Starting from raw materials, the value of the product is increased at every stage of the process and GST is collected for the value that is being added at each point.

- GST falls under indirect tax, because the customers don’t pay the amount directly to the government. Instead, they pay the amount to the retailers or service providers, who transfer it to the Government.

Why GST?

The GST was first implemented in the year 2017 in India, prior to which tax was paid in the form of VAT. Introduction of GST put an end to lot of problems that existed in the previous system.

i. One Nation, One Tax objective:

State governments imposed various taxes on their states prior to the GST. Despite the fact there was a central excise and VAT, state agencies also had their own tax terms and norms.

All the other taxes in India were eliminated by GST. The Central Government is the governing authority of tax imposition in the nation. The GST is the only tax across the nation that is levied at the same percentage in all states and union territories.

ii. Removed all other tax laws and policies:

The previous tax structure had many tax laws and terms like the VAT, Central excise, State excise, Service tax, Entertainment tax and much more. The tax laws were separated between the central and state bodies.

There was confusion and exploitation of the tax amount that citizens were paying as a result of this separation. GST is now a centralized tax that is applicable to all the governing bodies and ended the confusion that prevailed with the previous tax structure.

iii. Tax credits:

GST makes it possible for citizens and business people to be able to claim a certain amount as tax credits. This helps them reduce the amount they have to pay.

Tax credits can be obtained by producing necessary invoices and purchase bills that are made by the business or organisation. The system of e-invoicing was introduced through this newly introduced tax method.

iv. Reduced tax by-passers:

The previous tax structure provided people with a way to dodge or escape paying the required amount of tax to the government. The governing bodies had to deal with many more issues because of this.

Now, as GST is a single tax system for the whole nation, it has turned out to be more effective. Citizens who are late with their payments or who avoid paying are easily identified and the problem is resolved.

v. Reduced costs:

Several taxes are imposed on a single product under the VAT system. As a result, the cost of the product increased, and the production sector was greatly impacted.

For a particular product, central taxes, state taxes, service taxes and much more were being imposed. Now with GST, the overall tax costs are reduced, as every product has a single tax to be paid.

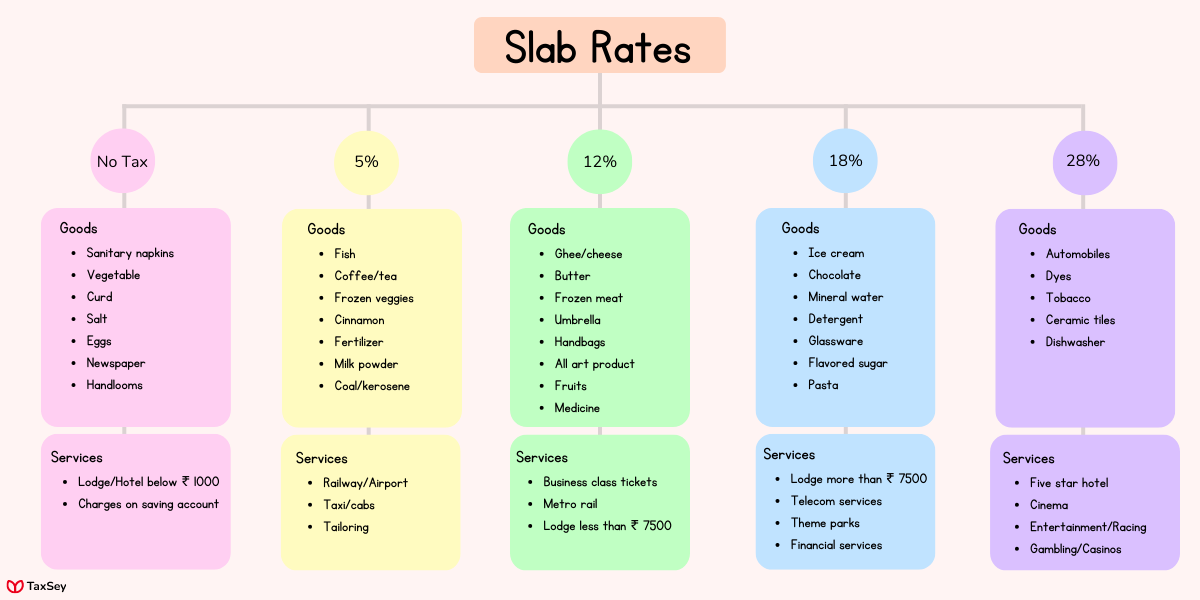

GST Slab Rates:

GST percentage for every product is fixed under these slab rates. These slab rates are structured in such a way that they are dependent on the current market trend and industry demands.

The slab rates allows the citizen to exactly know the amount of tax they have to pay for the product they are buying. This lead to an increased transparency over the taxing system.

GST slab rates are divided into 5 categories,

- No tax

- 5%

- 12%

- 18%

- 28%

These slab rates are fixed in such a way that the essential commodities get the least rates and luxury products are at the higher end. Across India, the GST council has finalized around 1300 goods and 500 services that fall into these slab rates.

Conclusion

The introduction of GST, has paved way to many changes in the tax system of India. It completely removed the problems caused by the various tax system and the exploitation of tax terms.

Major problem that was faced with the VAT system is that, taxes were levied on tax itself. This tax on tax lead to the increased rates of commodities and the consumption level went extremely low.

Thus GST, was on great solution for various problems that prevailed with the finance in India. This also lead to new technologies like e-invoicing, e-way bills and made tax payments easier and transparent.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption. The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.