GST Exemption list

Taxes are the sole responsibility of every citizen in every country. It is through the taxes that are being paid that the government can perform its civil duties.

The past decade witnessed certain changes in the taxation period, and that is when GST was implemented and enforced in India. By now everyone will be aware of what exactly is GST.

Here let’s look at how taxes are levied under the terms and policies of GST.

GST: Definition

Goods and Services Tax (GST) is a single taxation method that is being followed in India from July 1st 2017. The introduction of GST put an end to the divided and complex method of collecting tax in India.

GST leads to many benefits.

- A single taxation system was followed throughout the country.

- Tax on taxes was removed.

- People who escaped tax payments were identified and much more.

- GST eliminated the old VAT method and replaced it with an easier method of paying taxes.

GST Exemption

GST did bring all tax terms under one common roof for business, organizations and individuals. It was also mandatory to register for GST and file it periodically.

However, GST registration and filing is not like income tax. Certain exemptions and categories of people are not subject to GST payments. So what is the criteria for GST exemption and who can avail this benefit should be explained in detail.

What is supply in GST?

Supply in general terms has various meanings, but supply in GST means a situation where taxation can be applied. In simpler terms, when businesses or companies can pay GST, they fall under supply of GST.

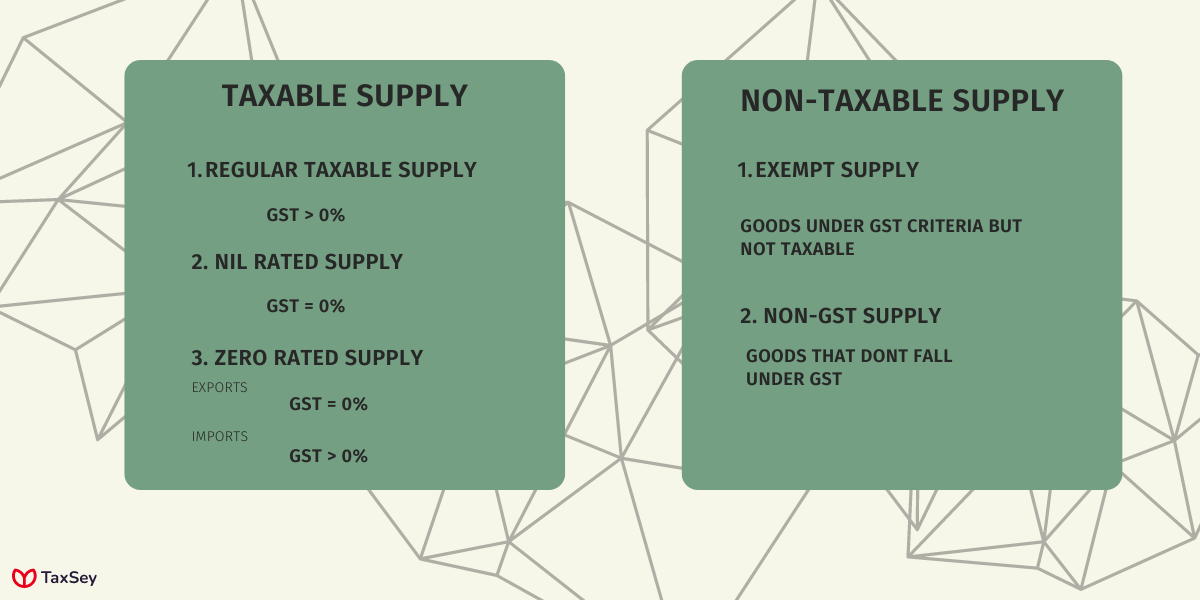

GST supply is categorized into two divisions, which has sub-divisions as well,

a) Taxable supplies:

This means goods or services for which GST can be levied under the GST Act. The products fall under the taxable category.

- Regular taxable supply: A supply of goods and services subject to a minimum amount of GST greater than 0%.

- Nil rated supply: This is when goods and services are taxable but fall into GST category where the interest rate is equal to 0%.

- Zero-rated supply: When goods and services are exported, the GST rate is 0%. The same product will, however, have a GST greater than 0 within the country.

b) Non-taxable supplies: Under this category, regardless of whether the goods or services fall under the GST Act or not, there will be no GST charged on them.

- Exempt supply: Goods and services are exempt from GST regardless of whether the business or organization is registered for GST

- Non-GST supply: Goods and services that do not fall under the GST rules are referred to as non-GST supplies.

Types of exemptions:

Exemption depends on certain factors, like Supplier/receiver

- .Export/import

- .Interstate/intrastate

- .ype of goods and services

- .GST amendment Act

Based on these factors, exemption under GST is divided into three types,

1. Absolute exemption: This means the exemption of GST is applicable irrespective of the above mentioned factors.

2. Conditional exemption: Conditional exemption s applicable only when the goods and services fall under the terms and conditions of GST Act.

3. Partial exemption: This exemption is applicable when an unregistered GST individual supplies his products to a registered GST individual.

Criteria for exempt supply:

Not all goods and products fall under the exemption category. There are certain criteria and reasons to be eligible for exempt supplies in Section 11 of the GST Act and Section 6 of the IGST Act.

- The supplies should have GST interest equal to 0 (i.e., Nil rated supply)

- The business or supply must not be a GST taxable event.

- GST council of India can recommend certain goods and services to be exempt from taxes.

- When the goods and services are beneficial to the public, the government will offer an exemption.

- On providing special official notice, certain specific supplies can be exempt from GST.

- It is possible to have GST exemptions for supplies under certain unforeseen conditions.

What is GST exemption under registration?

After the introduction of GST in India, it was made mandatory to register under GST. To pursue any sort of business it was mandatory to have a GST registration.

However, under certain conditions it was not necessary to register.

- When you are an Agriculturalist.

- A non-GST supply or a nil-rated supply is when your company's goods do not fall under GST.

- Non-GST supply - Petrol, Alcohol or products of human consumption.

- Nil-rated supply - Honey, grains, salt etc.

- When the overall turnover of the business is within GST threshold limit. (i.e., INR 40 lakhs for goods, INR 20 lakhs for services and INR 10 to 20 lakhs for special category)

- When your business is under the reverse charge category of GST.

- When you perform activities that are not covered by the GST Act, such as funeral services.

What is GST exemption for start-ups or small businesses?

This exemption can be used fully by individuals who have small businesses or growing start-ups.

In the case of goods,

- The aggregate turnover of the business supplying goods should be less than INR The same is true for hilly or Northeastern states of India, the limit is up to INR 20 lakhs.

In the case of services,

- Business activities related to the services should have a turnover less than INR 20 lakhs.

- In hilly or Northeastern states of India the limit is reduced to INR 10 lakhs.

- When your small business has an income less than 5 crores, you can avail the benefit of filing GST on a quarterly basis.

From the GST council meeting that was held in 2019, a lot of benefits were created for micro, small and MSME industries.

GST Exemption - GOODS:

A wide variety of goods are accepted under the exempted goods list under GST. There could be many reasons for this exemption, but primarily it is decided by the government based on how beneficial it is to the public.

Generally unprocessed goods or raw materials are the ones which are exempted in this case.

Raw materials before processing can be exempted goods, but the same raw materials after processing or manufacturing will be liable to taxation under GST Act.

List of goods that are exempted:

1. Food products:

- Fruits and Vegetables - Plants, roots, flowers, leaves

- Cereals - Rice, Wheat, Oats, Barley etc

- Meat and Fish (frozen or fresh)

- Plantation crops - tea, coffee

- Spices - pepper, clove, turmeric etc

- Seeds - sesame, groundnut, flower seeds etc

- Dairy products - milk and curd

2. Raw materials

- Fabrics - silk wool, raw silk, jute fibers

- Cotton - khadi, yarn, handlooms

- Fuel - Firewood, fossils, charcoal

3. Instruments

- Agricultural tools - spades, shovels, hand trowel etc

- Hand tools - hammer, wrench, pliers etc

- Musical instruments

- Equipment for physically challenged people - hearing aids, visual aids etc

4. Other products

- Medical products - drugs, vaccines, contraceptives etc

- Fertilizers - manure

- Live animals - cows, sheep, goats, poultry

- Newspapers, books, journals, non-judicial stamps etc

- Pottery - handmade pots, earthenware pots, clay pots, ceramics etc

GST Exemption - Services

Just like the previous category a list of services can also be exempted form GST taxation. This is applicable when the GST council and government finds it useful for the public.

Certain services can also be exempt from GST on the basis of a special order.

List of services that are exempted:

- Agricultural services - harvesting, leasing machinery, cultivation, farm labouring, packaging etc.

- Animal husbandry - rearing of animals, proper feeding etc.

- Transportation - Moving cargo by road, rail, and water both within and outside of India.

- Education - hiring faculty, examination centers, mid-day meals etc.

- Medical services - ambulance, medical professionals like nurses, doctors, paramedics.

- Organizing exhibitions for foreign visitors and organizing tours.

- Diplomatic services between the government and diplomats outside India.

- Library services are also included

- Services by authorized sports organizations, religion organizations can also avail of the exemption.

Negative list under GST:

There are a list of items that don’t fall under the GST Act. This list is called the negative list of GST.

- Funeral, burial and crematorium services

- Selling lands or agricultural plots.

- Selling fully constructed buildings.

- Judicial or court services.

- Services provided by government officials like MP, MLA etc.

CONCLUSION:

The VAT method of collecting tax had various loop holes and the system was exploited by various authorities. Thus the introduction One nation One tax system with GST was an efficient idea.

In consideration of the public and services rendered by businesses, the government and the GST council came up with a list of exemptions that are referred to as GST exempt supplies.

This was made to provide exemption from paying GST under certain criteria. Therefore, any individual who qualifies under the above mentioned list is exempt from GST.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption. The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.