Agricultural Income in India

In India, agriculture is a major source of income. The income generated can be generated from owning agricultural land or through cultivation. Income from these sources is taxed under a special taxation category called Agricultural Income.

This division is intended to promote agriculture and provide tax benefits to the people. These tax exemptions are also a benefit in conjunction with other schemes, loans, and policies.

Nevertheless, there are still many details that need to be known in order to qualify for tax exemptions. This article will explain the details of agricultural income.

Agricultural income: Definition

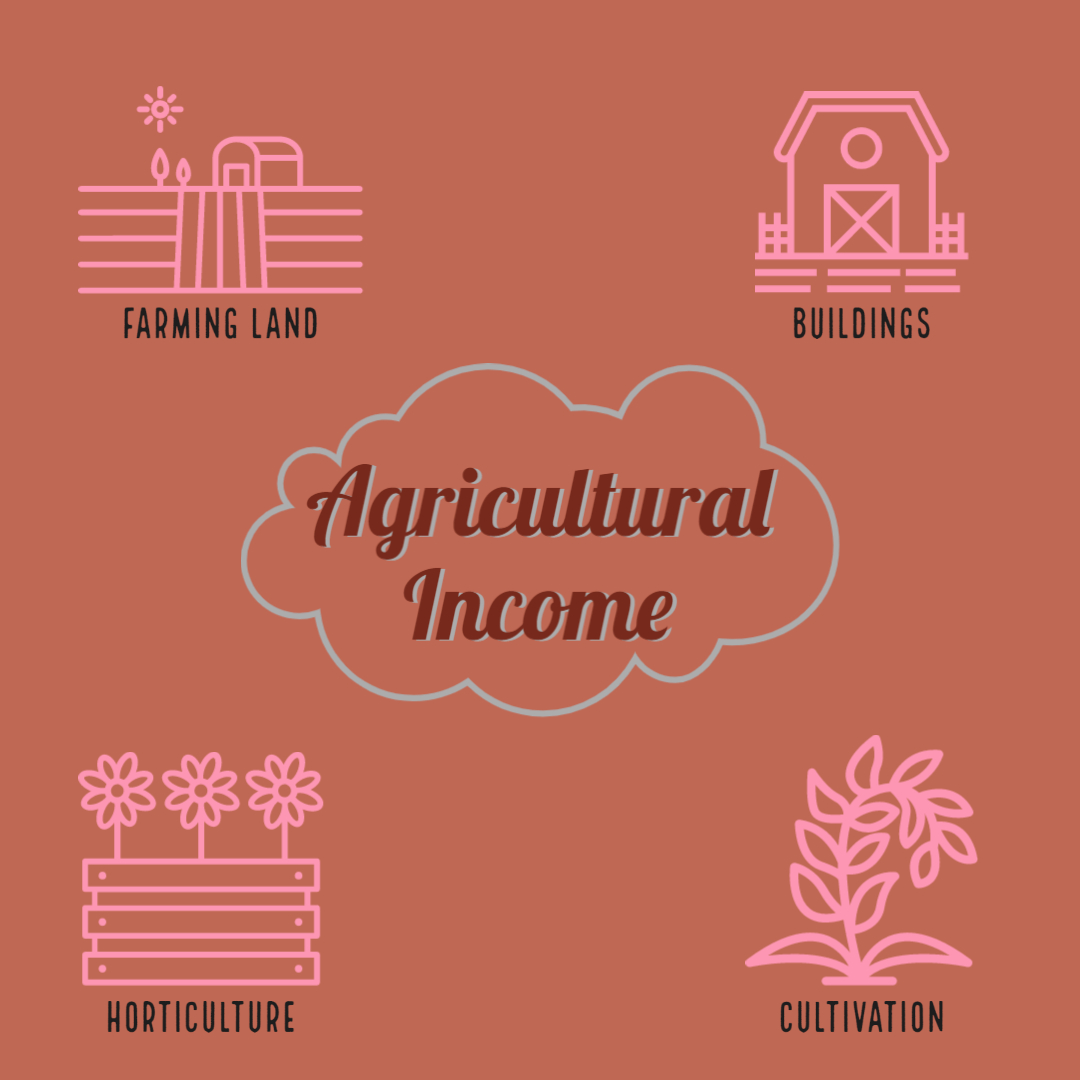

The definition is simple as the name suggests, agricultural income is nothing but the revenue generated through agricultural practices. This is clearly defined and explained by section 2(1A) of the Income Tax Act, 1961.

The section defines three clauses:

a. The income generated can be in the form of rent from agricultural land located in India and should be used only for agricultural purposes.

b. Income from the land can be generated in the form of,

i. Agriculture

ii. The revenue earned from the commercial sale of products grown on the land.

c. The revenue earned can be by renting or leasing agricultural buildings that perform agricultural activities. The buildings can be farmhouses.

Examples of Agricultural income:

Now that we know what is meant by agricultural income, let’s look at a few examples to better understand the clauses.

Land rent that is obtained from agricultural land situated in India.

- Revenue earned from growing and sale of flowers/creepers.

- Income from the sale of replanted plants.

- Income derived from the commercial sale of seeds.

- Profit earned or shared between partners of any agricultural firm.

Interests earned from a partnership with an agricultural business.

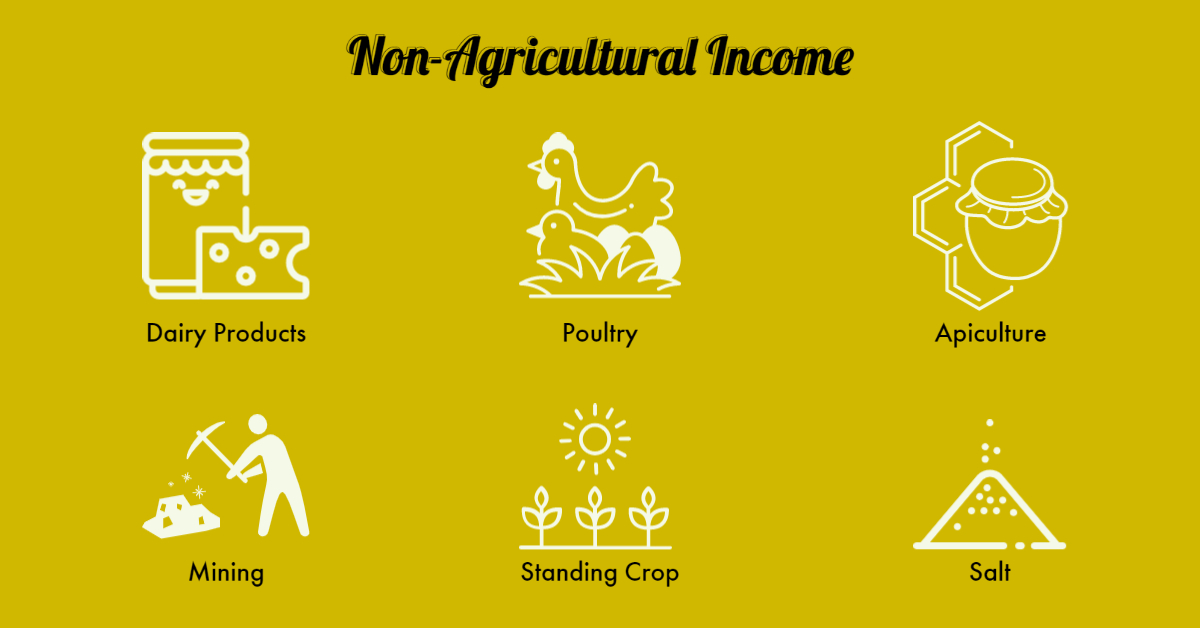

Non-Agricultural income:

Though there are various products that are produced through agricultural means, they don’t fall under the category of agricultural products. The list of those products are stated below,

Revenue earned from rearing poultry or by maintaining poultry farm.

-

Income from Apiculture.

-

Income earned from dairy products and dairy farming.

-

Standing crop sale.

-

Income from mining and mines.

-

Butter and cheese products.

-

Revenue obtained from lease or sale of growing trees.

-

The revenue earned by salt production from sea waters.

How to calculate agricultural income?

It is essential to know and calculate the tax that is associated with agricultural income. It is common for agricultural income to be combined with other sources of income that are taxed at varying rates.

The steps to calculate agricultural income are,

-

First calculate the tax on the total income earned by an individual, i.e., Salary income + agricultural income. This is basically agricultural income and non agricultural income.

-

Now break down the total income into basic exemption limit and agricultural income. Tax is calculated on both separately.

-

The tax payable is the difference between the previously calculated taxes.

Example for calculating agricultural income:

Let's suppose an individual earns about Rs.0,000, and has an agricultural income of about Rs. 1,20,000 in one financial year.

So the total income earned is Rs. 6,20,000.

Step 1: Tax on total income Rs. 6,20,000 is calculated. Basic exemption is Rs. 2,50,000. An interest of 5% is levied on the remaining income, which is about Rs. 18,500.

Step 2: Tax on agricultural income is calculated.

Rs. 1,20,000 is the agricultural income earned by the individual. The same interest of 5% is applicable and the tax payable is Rs. 6,000.

Step 3: The tax amount calculated from both the steps is subtracted.

Rs. 18,500 - Rs. 6,000 = Rs. 9,500. Therefore for one financial year the total amount taxable is Rs. 12,500.

How are agricultural incomes taxable in India?

Agricultural income earned by an individual has certain exemptions under the Income Tax Act of India.

According to Section 10(1) of the Income Tax Act, the government cannot levy tax on the agricultural income earned by the tax payer.

- The agricultural income should be greater than Rs. 5000.

- Basic exemption is permitted in the income earned from non-agricultural sources. There is an exemption of Rs. 2,50,000 for individuals under the age of 60. For senior citizens above 60 years, the exemption is Rs. 3,00,000.

Under Section 54B of the income tax act, there are certain exemptions that taxpayers may claim. Generally, capital gains from transferring agricultural land to another investment are tax-deductible. The conditions to avail of this exemption are,

-

This section is applicable to either an individual or HUF.

-

The land or asset that is transferred should be used for agricultural purposes for a minimum of 2 years. The land can be used by the tax payer or their parents for agricultural purposes.

-

Another agricultural land should be bought by the taxpayer within a period of 2 years, from the date of sale of the previous land.

-

Additionally, newly purchased land should not be sold for three years, and must be used for agricultural purposes.

Individuals who earn agricultural income are exempt from paying taxes under these conditions.

Conclusion:

Income is categorized into specific categories to separate agricultural income from other sources of income. The interest rate on agricultural income is fixed according to a variety of slab rates and criteria.

To report the details of agricultural revenue earned, forms ITR-1 and ITR-2 must be filled out. Check the details of your tax exemption to ensure you are exempt from paying taxes.

Frequently Asked Questions

DDT stands for Dividend Distribution Tax which is required to be paid by the companies on the dividends they issue. As per Budget 2020 speech, no Dividend Distribution Tax (DDT) shall be paid by the Companies from FY 2020-21.