Steps to track PAN card application status online

Along with various other identification cards issued by the Government, PAN card is also crucial. This PAN number stands as an effective identifier for taxpayers in India and it is mandatory to have a PAN card.

Applying for a PAN card can be done online through the website. But what’s next? You must know the updates on when the PAN card will reach your residence. That’s what we are going to read in this article.

1. Why is PAN card needed?

Similar to how Aadhaar is used as the primary identification document across India, PANs are also used as a means of identifying taxpayers. Every taxpayer can only have one PAN number.

The importance of having a PAN card is because it contains all information related to the financial transaction of an individual. All tax related information is recorded so that the income tax department can track the transactions made by the individual easily.

2. How to apply for a PAN card?

As every individual needs a PAN card, the next step is to know how to apply one. You can apply for a new card or a duplicate. Below are the steps for applying for a PAN card.

You can apply for a PAN card online or offline.

3. Apply PAN card - offline

If you want to apply for a PAN card in offline mode, then it is done with the help of form 49A. It is given by the income tax department of India and is specifically for filling out information regarding PAN cards.

- Go to the NSDL portal https://nsdl.co.in/

- Download the Form 49A from the website.

- Fill out all the required information on the form.

- Along with the application, you must attach your photograph and a copy of documents like identity proof and resident proof.

- Submit the application form and documents to the nearest TIN-FC PAN centre.

- Application charges can be done through DD payment, cash or e-payment.

- Details related to your PAN card will be sent to your email or registered mobile number.

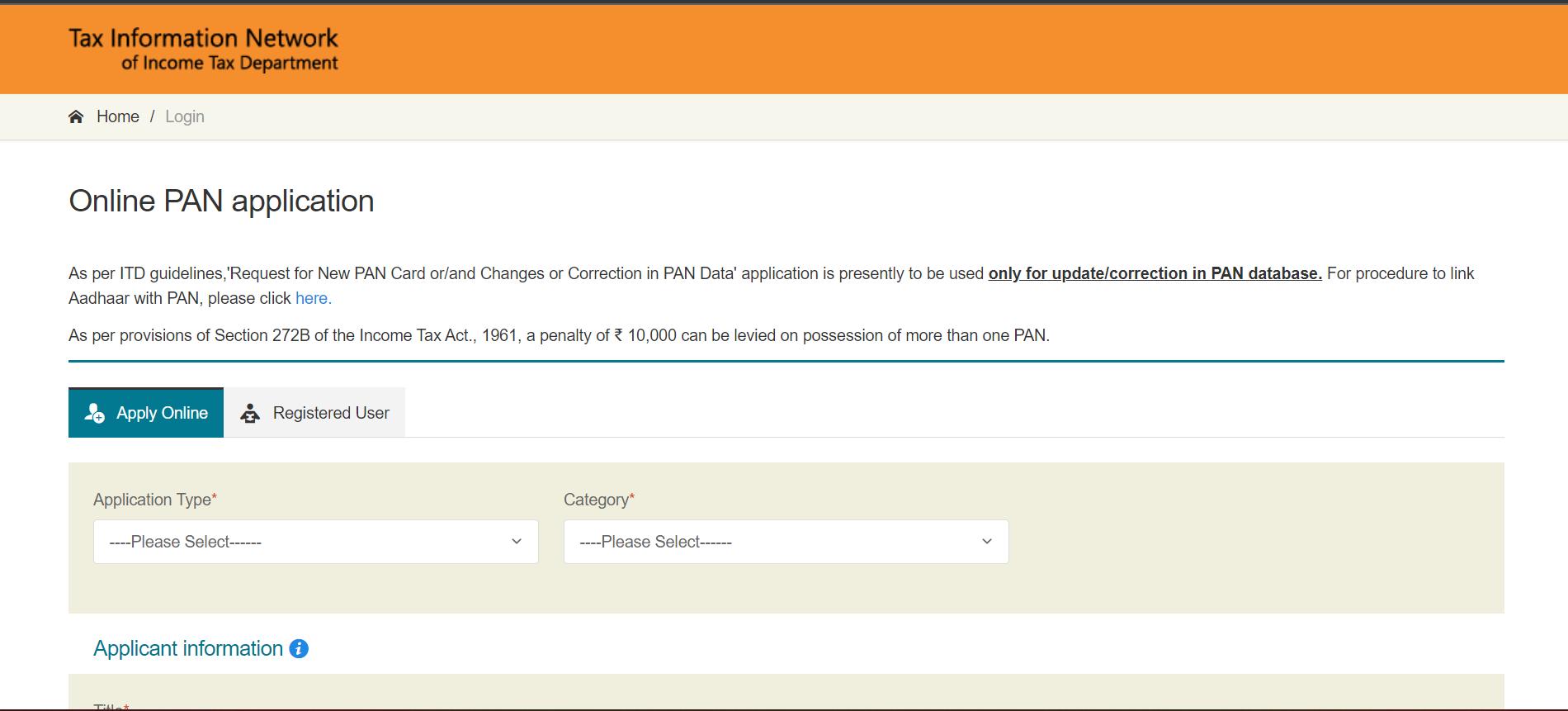

4. Apply PAN card - Online

Applying PAN card online is available 24/7 and takes only 10 minutes to complete the entire process.

- Go to the link https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

- Click on Apply Online.

- Select the Application Type and Category specified in the box.

- Then proceed with filling in the applicant details and click on Submit.

- A token number will be generated to help in filling the PAN card application form.

- The form 49A appears, and you fill out the details.

- Click submit after attaching the necessary documents.

- Verify if all the information you entered is correct and proceed with the payment.

- Once the payment is done, download the pre-filled application form from the website.

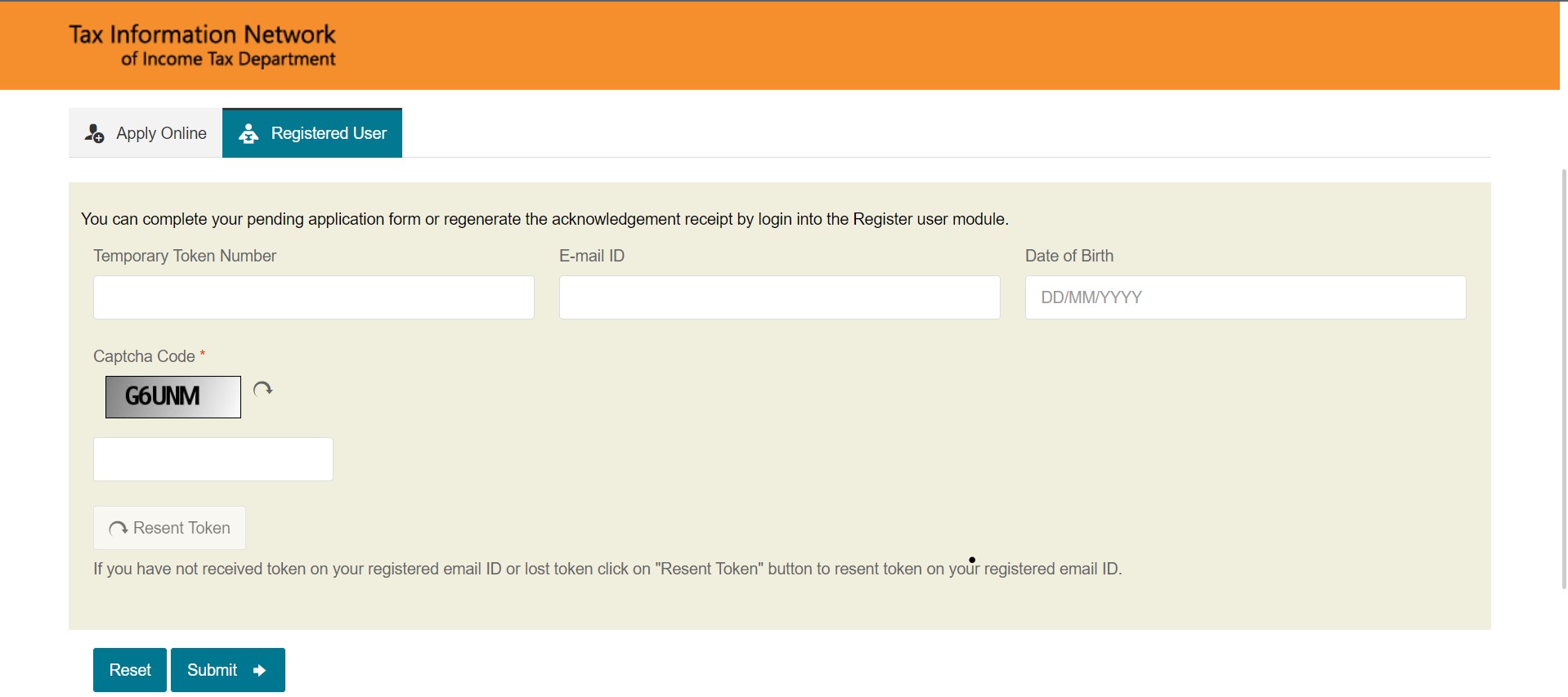

- If you want to apply for a PAN card later, click on Registered User. Enter your email id, DOB and the token number to proceed with the same process.

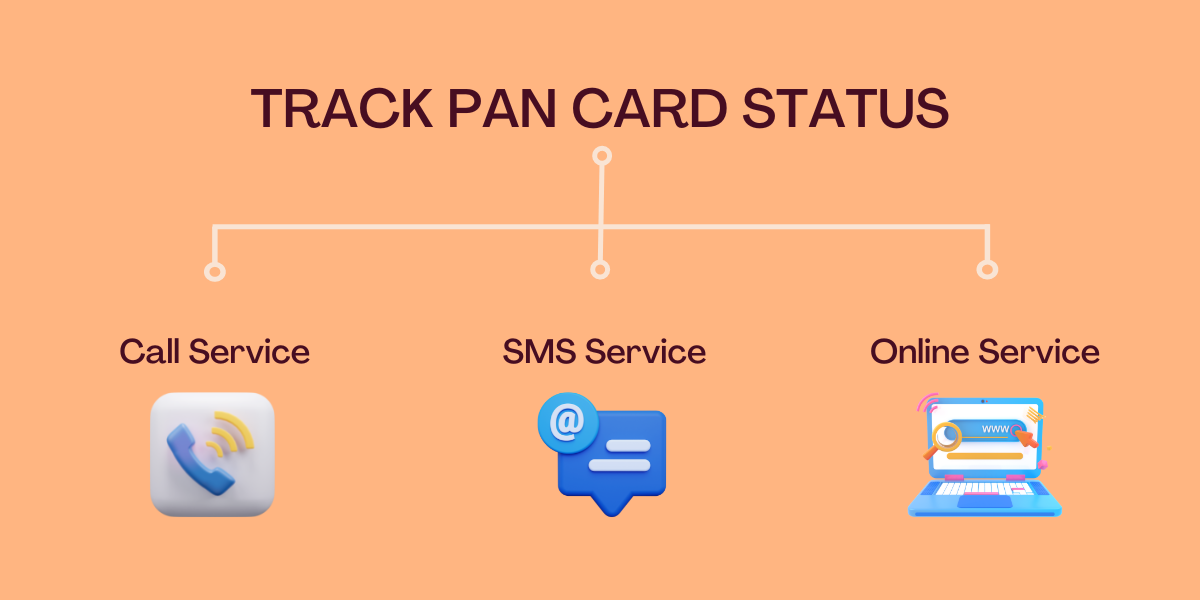

5. How to track PAN card application status?

Now that you have applied for a PAN card, you must know when it will reach you. It is extremely useful to check the status of the PAN card. You have three ways to check your PAN card status.

a) Call service: Make a call to the TIN call centre number which is 020-27218080. You can find out information about your PAN card by providing your 15 digit acknowledgment number. (b) SMS service: Just as with the call service, send a text containing the 15 digit acknowledgment number to 57575. You will receive a SMS back with the details regarding your PAN card status. c) Online service: To know the status of your application online, there are three ways.

i. TIN NSDL portal ii. UTIITSL portal iii. e-Mudhra portal

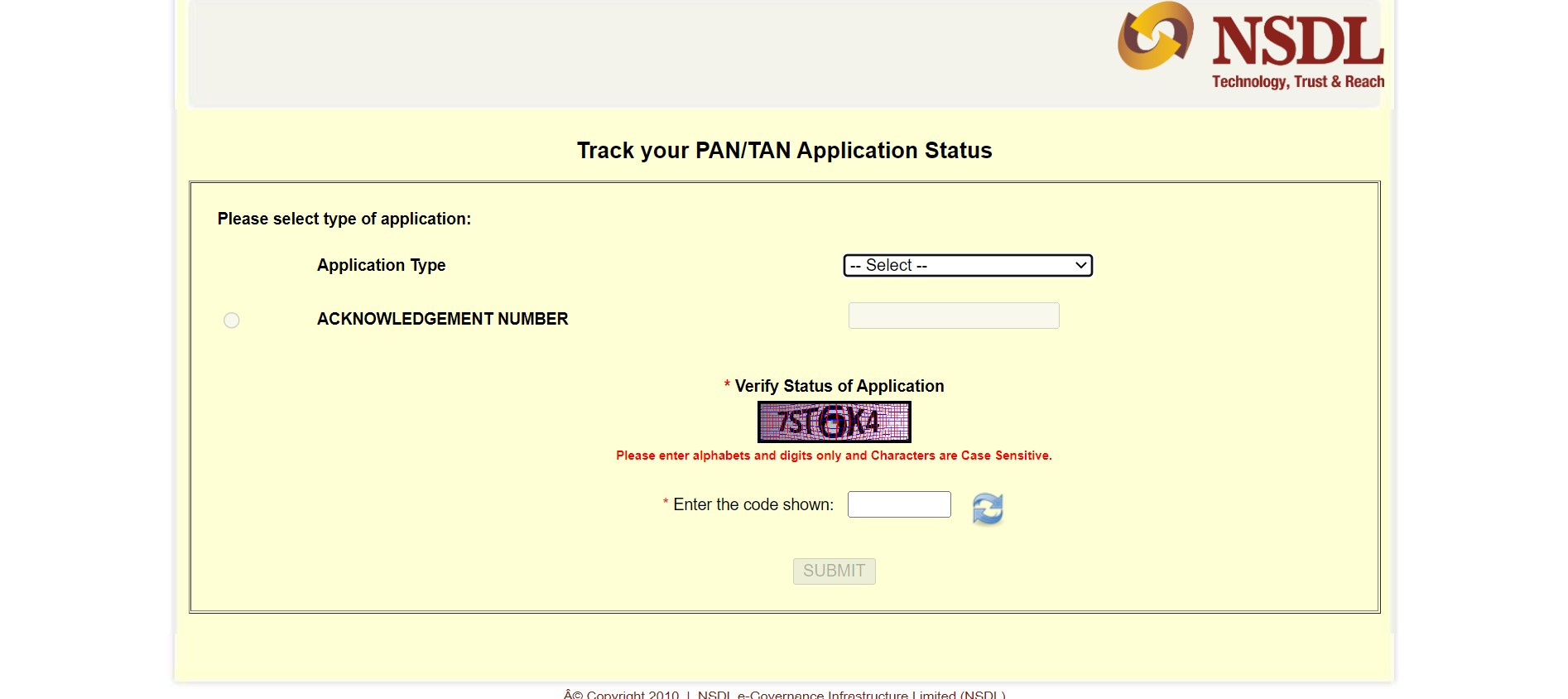

6. NSDL Portal

- Click on the link https://tin.tin.nsdl.com/pantan/StatusTrack.html

- On the application field, select PAN New/Change request.

- Enter your 15 digit acknowledgement number and the captcha code.

- Click submit to get the details.

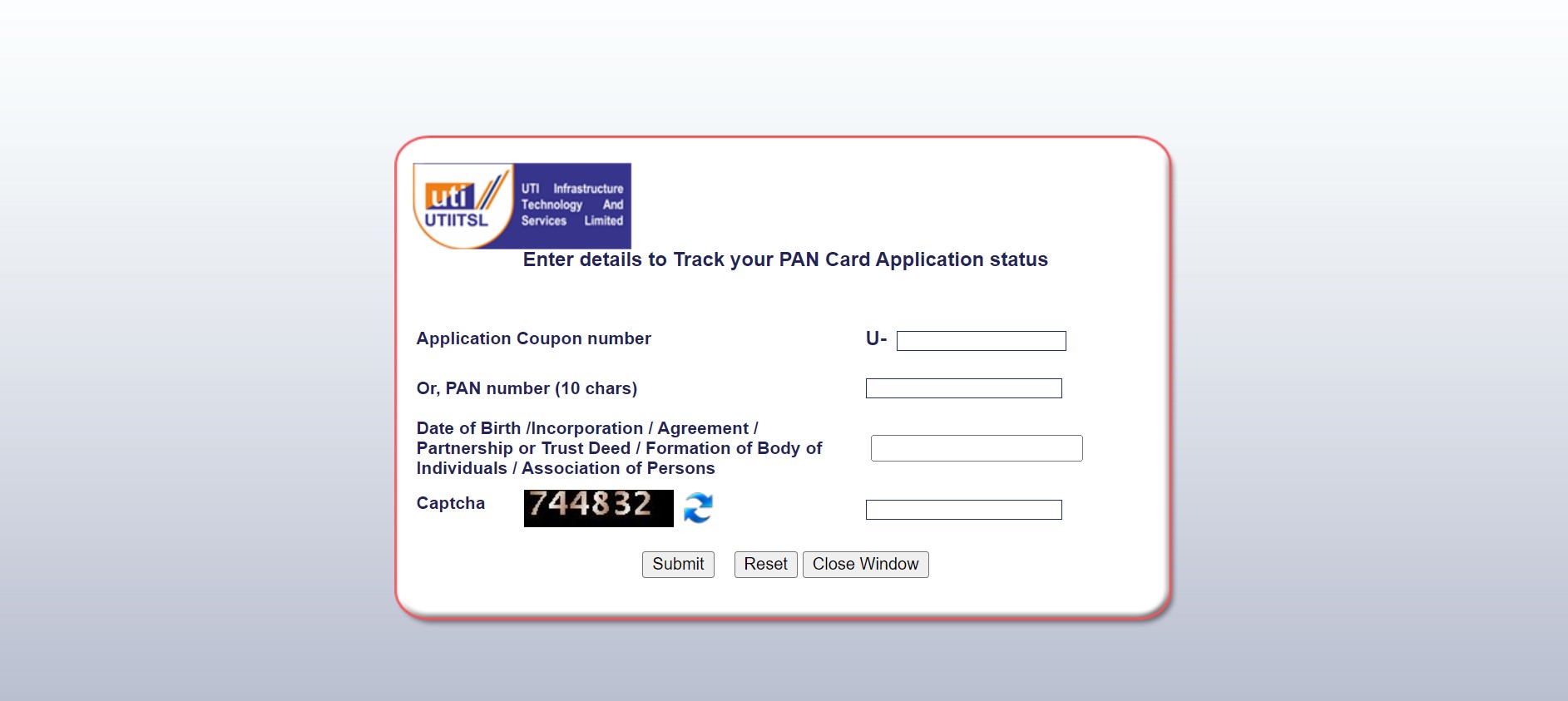

7. UTIITSL Portal

- Visit the link https://www.trackpan.utiitsl.com/PANONLINE/#forward

- To check the status through this portal, you should know the application coupon number.

- Enter the coupon number and captcha code.

- Click submit to get the details.

- If you have applied for any correction or change in PAN card, then it is enough to enter the 10 digit PAN number instead of the coupon number.

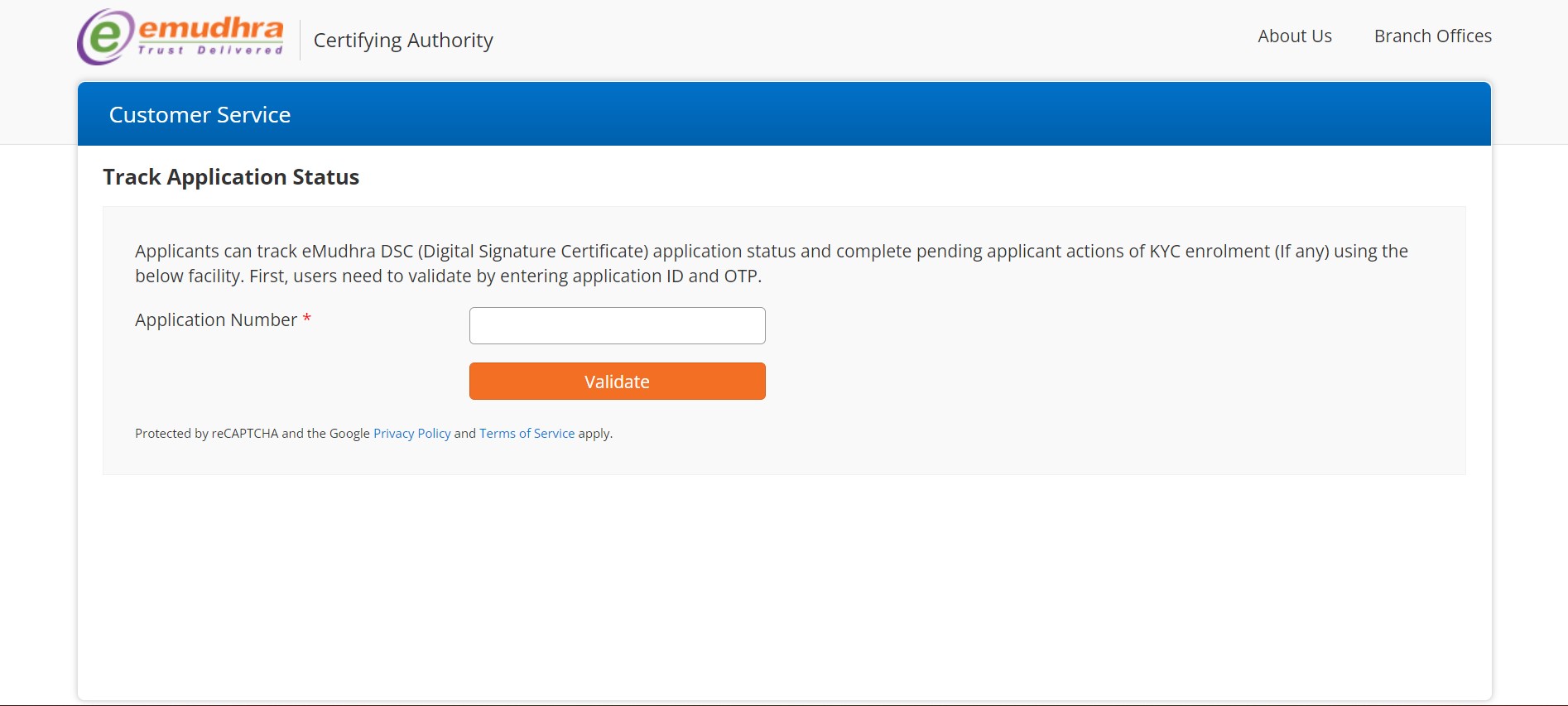

8. e-Mudhra Portal

- Visit the link https://subscriber.e-mudhra.com/ApplicationStatus.jsp

- Enter the application number that was given while applying for a new or duplicate PAN card.

- Validate the application number and an OTP will be sent to the registered mobile number.

- Enter the OTP and click OK to get the details.

Conclusion

Usually it takes around 15 to 20 days for the PAN card to reach you. But it is always better to track and know the status of the PAN card. If there are any problem with the delivery or the package got delivered in the wrong address, then tracking of PAN card will be helpful.

Once you apply for a PAN card, you should check its status frequently. If the card hasn’t reached you, raise a complaint and get it resolved at the earliest.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption.