Everything you need to know about SIP Calculator:

People are looking forward to make their money grow. When the money that you earn remains stagnated, then there isn’t any use out of it. Business people and other professionals seek out different ways to multiply what they earn.

One way of increasing your wealth is by investing. Investing is defined as a way of growing money through assets, deposits, bonds, funds and much more. This is considered as a smart way of multiplying.

The next step to start investing is to have a plan and to do so we have got the SIP calculator. So what is SIP calculator, how does it work and much more questions are answered through this article.

What is SIP?

SIP which is abbreviated for Systematic Investment Plan is a detailed structure for the investors to decide on how to invest their money. With SIP the investing is done at regular intervals with similar payments.

Under SIP, the investments are made in the form of mutual funds, trading accounts or retirement plans. When you choose a SIP the payments are done automatically and periodically.

The basic idea behind choosing a SIP is to convert small amounts of money to larger profits in a short span of time. The intervals can also be customized as weekly, monthly or quarterly.

SIP calculator: Introduction

If you want to grow your money in a short and smart way, then you should plan it out using a SIP calculator.

So what does a SIP calculator do?

Everyone’s thought is to know the profit of the work that they do. The same applies for investing. The final returns or profits should be known before hand, for the investor to start investing.

The role of SIP calculator is to let the investor know about the profit they are generating through investing. In general, SIP calculator is used to calculate the returns of SIP mutual fund investments.

How to invest in SIP?

Randomly investing in a huge amount isn’t a great way of spending your money. Instead having an organized plan will be preferred and we can expect profits.

Understanding and implementing SIP could be one good way of investing in the right way. So how is that done?

1. Know your needs:

The basic step before investing is to know, or predict what we need. Say it in a period of 10 years how do you want your wealth to grow exponentially.

2. Analyze your financial assets:

Investing should be done based on equity and debt that you hold. Investing more than you have will lead to extensive financial crisis.

3. Select the mode of investing:

You should then find out the right way of investing the money. There are plenty was like mutual funds, buying property, etc. Based on you finance and needs, the right investing option should be selected.

4. Complete the process:

Now by fill the application form and submit necessary documents like identity and address proof. Then complete the KYC process.

5. Select the period:

Finally select the SIP period which gains high profits. At the end of the period, the amount will be automatically credit to your account.

How to use SIP calculator?

Sounds like a normal calculator, but with the context of investing is what SIP does. But the results obtained are based on the values that you give just like how you do in a calculator.

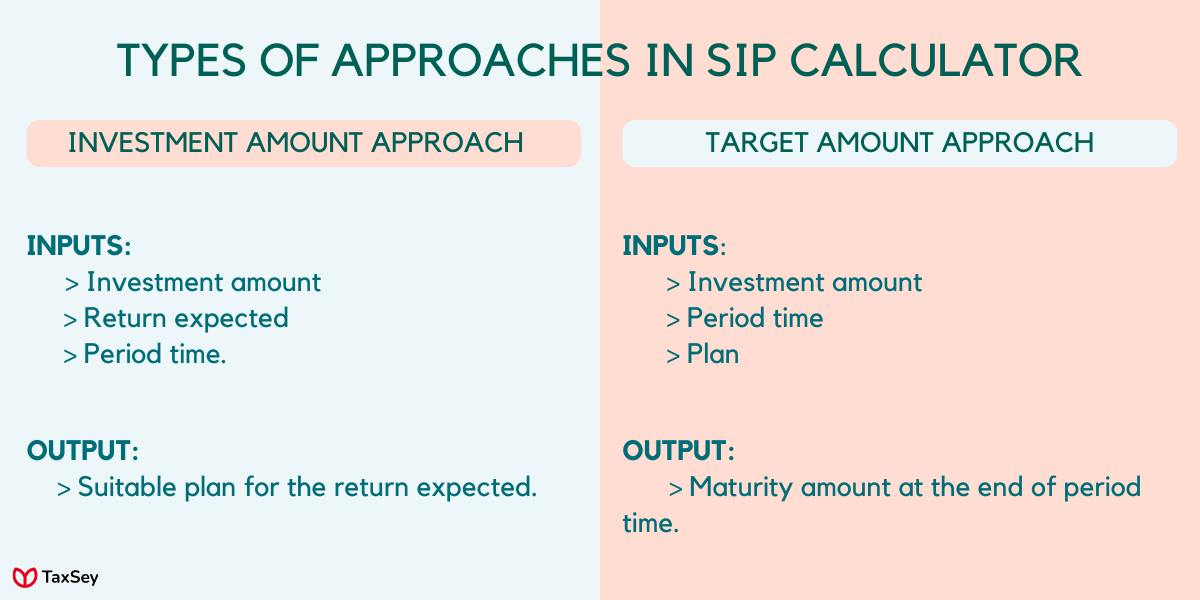

SIP calculators can be used to track down two types of approaches.

i. Investment amount approach: here all inputs are given, like investment amount, return expected after the period, tenure etc and the plan is determined.

ii. Target amount approach: in this case the period is given from which the return obtained will be calculated.

The basic calculation is dependent on a formula,

M = P*{[1 + i]n - 1] / i}(1 + i)

Where,

M - Amount received at maturity P - Principal amount invested n - Number of payments that should be made i - interest rate

Let’s look at an example,

If the Principal amount that is invested is Rs. 7500 for a period of 15 years. You have to make around 10 payments at an interest of 5% to get the total maturity amount.

M = 7500*{[1 + 5]10 - 1] / 5}(1 + 5) M = Rs. 99050.9

So the maturity amount will be 99050.9 after 10 years.

How SIP calculator works?

The functioning and the results obtained are entirely based on the inputs that is given by the user. Estimating is the role of SIP calculators to help the investors choose the right way of multiplying their money.

- Input data is entered in the calculator. Input data includes

- Investment amount

- Period

- Expected return

- Step up interest

-

In case of Investment approach the profit gained by the investor can be calculated. We can analyze whether the investment results in a profit or loss for the selected tenure.

-

If its Target approach then the end maturity amount will be calculated. For the investment amount and final resulting amount for the tenure can be analyzed.

Benefits of SIP calculator:

- With the use of SIP calculator, you can immediately calculate the maturity amount at the end of period. This makes us to know the profits earned.

- The application is easier to use for everyone to start their investing immediately. Easily understandable and not complicated.

- This shows the exact results at the end of the period and gives a graphical representation on the potential gains.

- By giving different inputs to the calculator, you can find the best plan to invest your money.

Conclusion:

Investing is a wide field with risks on its own. Investors keep in highly careful to gain the best profits out of even the small money that they invest.

But still this investing remains not known to the common world, due to its potential risks and fears. Mostly people tend to avoid it.

At the same time, just keeping the money stay in the same place isn’t a great idea. Exploring various investing options, SIP is an easier and simpler way of multiplying your money.

Just calculate the gains that you expect using the calculator and start investing immediately.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption.