PAN Verification:

PAN card is an important and mandatory document for all citizens, whether they are salaried or non-salaried individuals. It is because a PAN card contains all the information related to a person's taxes and transactions. Usually the PAN card application is verified by the income tax department through certain government approved websites. Why and how this is done, will be focused on in this article.

1. Know your PAN

Know your PAN is a service that was initiated by the Income tax department of India, to access the details of PAN in emergency situations. Through this service we can,

Know your PAN is a service that was initiated by the Income tax department of India, to access the details of PAN in emergency situations. Through this service we can,

-

Access the number, when your PAN card isn’t with you.

-

Help in situations like when you lose or misplace the PAN card.

-

Cross check and verify the address in PAN can also be done through this service.

This method of obtaining PAN card information was misused, as the information required was date of birth, full name, and registered phone number. People could easily access the data, which lead to problems and so Income tax department discontinued this service.

2. What is PAN verification?

Know Your PAN is now referred to as PAN verification in the revised version. A few government-approved websites and links are used to conduct this process, which is mandatory for all PAN holders.

There are generally three methods of verifying a PAN:

- File Based PAN verification:

File based verification is usually done by Government or related organizations, where

- First login to the account (i.e., the user who is going to verify has an account)

- Usually a file containing 1000 PAN cards is uploaded in the website.

- After uploading, click on Submit.

- It takes about 24 hours to display all the details of the PAN card and holder.

- Screen Based PAN Verification:

The process is similar to file-based verification, which involves verifying PAN cards. Screen verification can be done only when you start using the surface.

- Just like file based verification, here also 1000 PAN cards are verified.

- The file containing all the PAN cards is uploaded as a .XML file.

- Click on submit and the details will display on the screen.

Software based PAN verification:

This is entirely dependent on software analysis and verification process of PAN card. Only a limited number of PAN cards can be verified at one time.

- Login to your respective accounts in the software.

- Enter the details of 5 PAN cards.

- Click on Submit to get the details for PAN card.

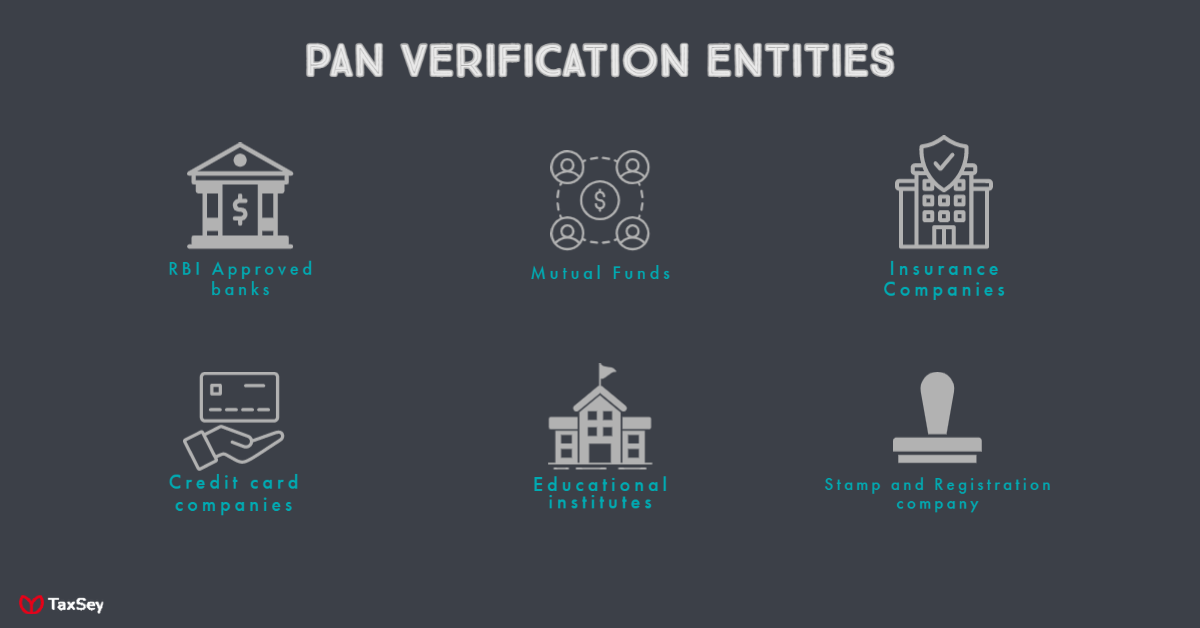

Eligibility for PAN verification:

The PAN verification operation is not available to all organizations and companies. Income Tax Department has given authority to certain entities to perform this verification process.

The PAN verification operation is not available to all organizations and companies. Income Tax Department has given authority to certain entities to perform this verification process.

NSDL e-Governance is one of the most popular websites and services that conduct this process. The other companies eligible for this program are:

- Reserve Bank of India

- Other banks that are approved by RBI

- Central vigilance commission

- Income tax project companies and organizations

- IRDAI approved brokers, who can verify PAN card

- In case of Non-banking companies, it should be approved by RBI

- State and Central Government agencies

- Insurance companies

- Credit card issuing companies

- Depositories

- Goods and service tax council

- Mutual funds

- House finance companies

- Central KYC registration agency

- Educational organizations that are recognized regulatory bodies.

- Insurance repository

- Stamp and registration companies

- Department of commercial taxes

3. Documents needed for PAN verification

In order to verify PAN number, there are certain details and documents that are required. Since the previous procedure was too easy for people to crack, this online verification process has a list of documents to be submitted during verification.

a. Payment Details:

- Amount paid during registration

- Mode of payment (Net banking, Credit/Debit cards, etc.)

- Instrument number

b. Company Details:

- Name of the registered company

- Category of company

- TAN or PAN

- Contact details

- Other details related to the company

c. Digital Certificate Details:

- Name of the signing authority

- Class of digital signature certificate

- Serial number of digital signature certificate

4. Online PAN verification process

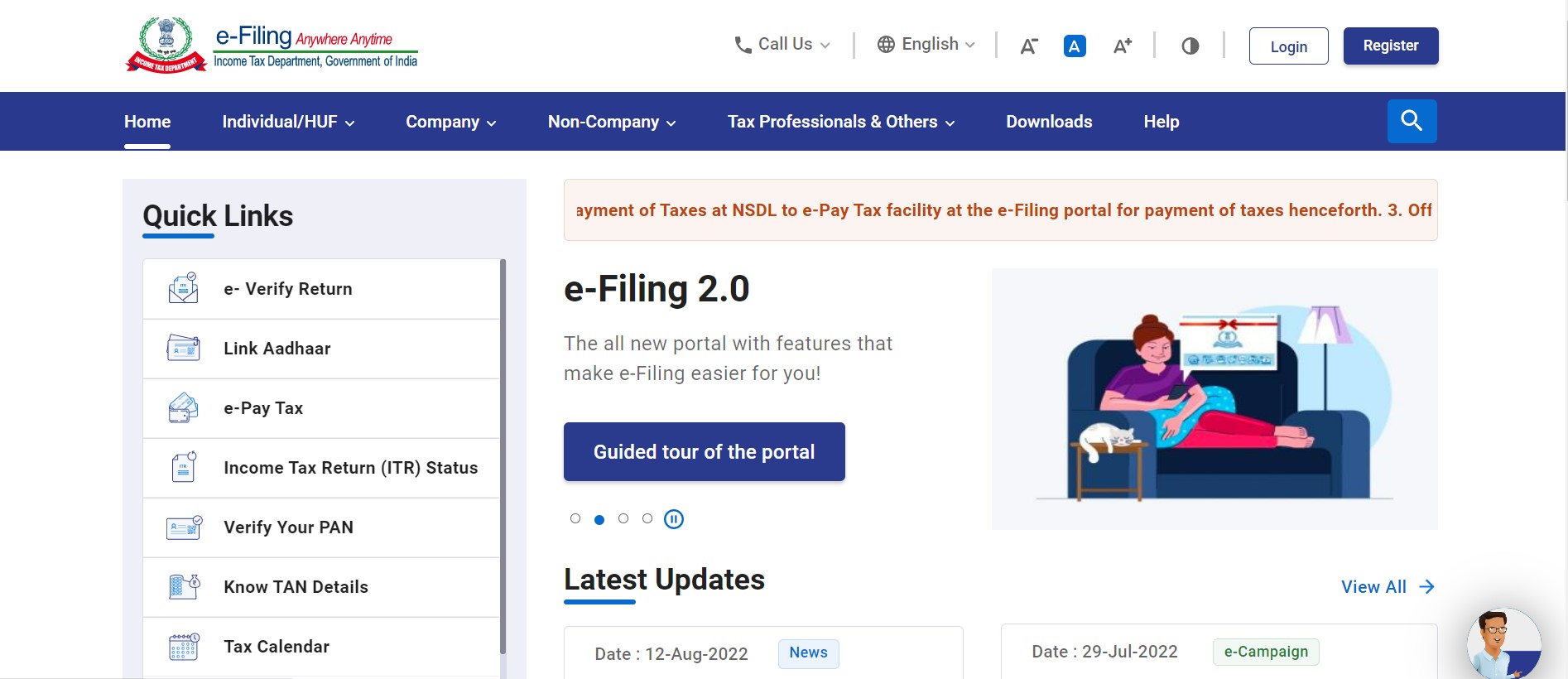

Your PAN can be verified using PAN details or through Aadhaar number. Let’s look at the steps involved in both processes.

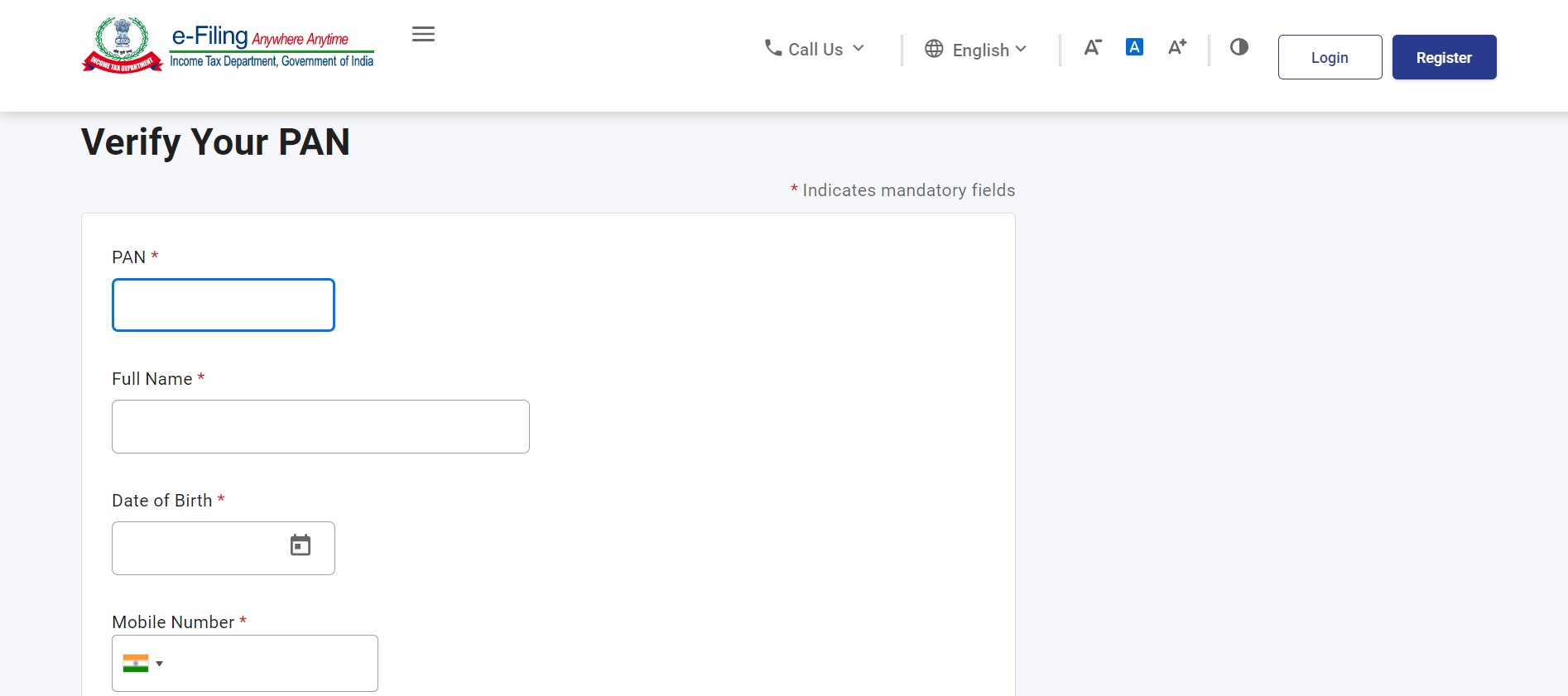

Verify using PAN details:

- Click on Income tax website https://www.incometax.gov.in/iec/foportal

2. Select the Verify PAN button on the left tool bar.

3. Fill in the details like PAN number, Full name, DOB and registered phone number.

2. Select the Verify PAN button on the left tool bar.

3. Fill in the details like PAN number, Full name, DOB and registered phone number.

4. Click continue.

5. A six digit OTP number will be sent to your registered phone number. Enter the OTP and validate your PAN

6. The PAN verification details will appear on the screen.

4. Click continue.

5. A six digit OTP number will be sent to your registered phone number. Enter the OTP and validate your PAN

6. The PAN verification details will appear on the screen.

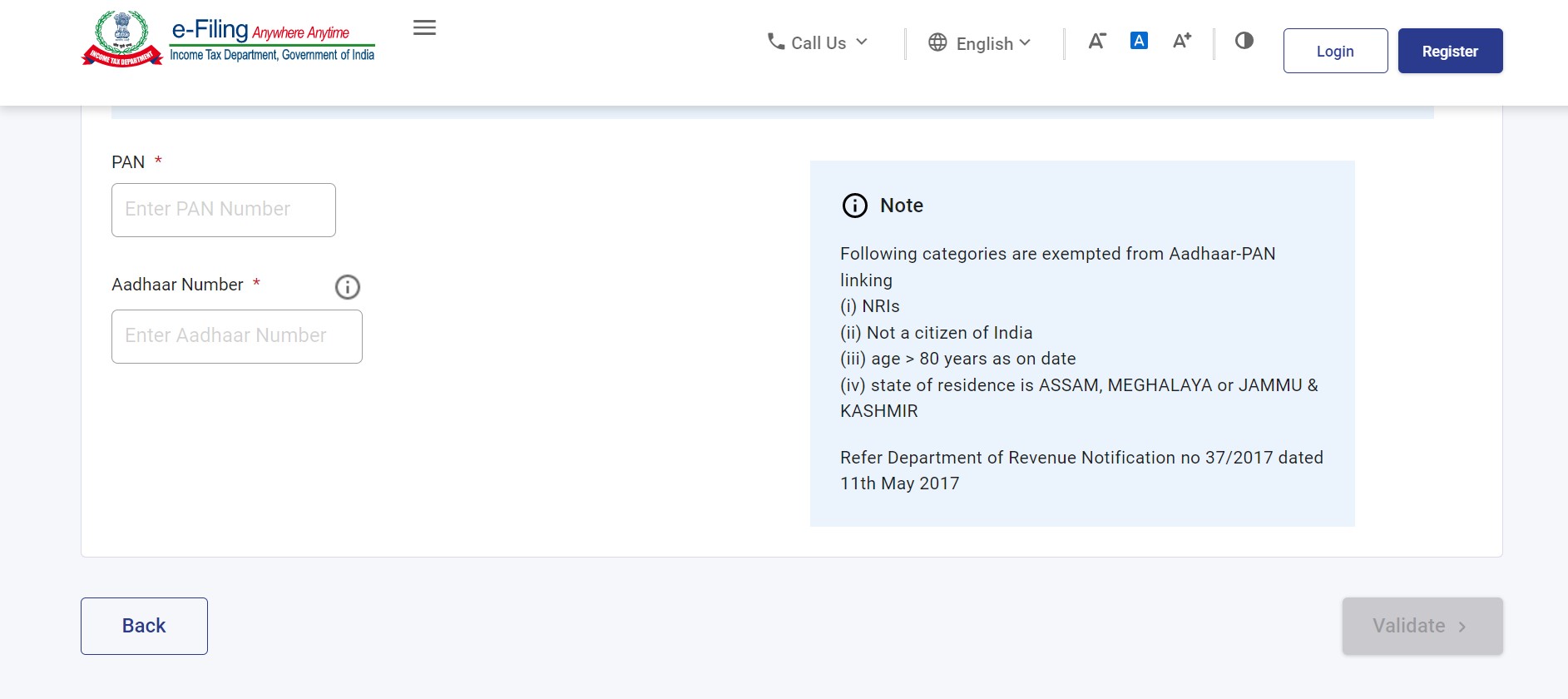

Verify using Aadhaar number:

- Click on Income tax website https://www.incometax.gov.in/iec/foportal

- Select Link Aadhaar in the left tool bar.

3. Enter the details of Aadhaar number and PAN number.

4. Click on validate and select link aadhaar option

5. The PAN verification details will appear on the screen.

3. Enter the details of Aadhaar number and PAN number.

4. Click on validate and select link aadhaar option

5. The PAN verification details will appear on the screen.

Conclusion:

A tax payer's PAN card is an important document to prove his or her financial status. It contains all details related to the transactions made by a taxpayer or company.

So why is it critical to verify a PAN number? PAN verification process enables us to maintain the authenticity of our PAN card. Hence, the Income Tax Department has made it mandatory for all taxpayers to go through this process.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption.